Introduction to Personal Finance: Beginning Your Financial Journey, 2nd Edition

By John Grable and Lance Palmer

Every financial decision we make impacts our lives. Introduction to Personal Finance: Beginning Your Financial Journey, 2e is designed to help students avoid early financial mistakes and provide the tools needed to secure a strong foundation for the future. Using engaging visuals and a modular approach, instructors can easily customize their course with topics that matter most to their students. This course empowers students to define their personal values and make smart financial decisions that help them achieve their goals.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Students learn practical life skills through application-making choices and creating positive habits to guide their life’s financial journey.

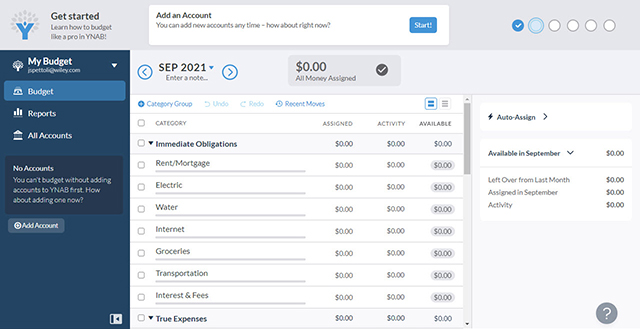

YNAB Budgeting Project: Using the award-winning You Need a Budget app, students set up a personal budget with video guidance from experts. All students (not just WileyPLUS users) get one year of free access to the app.

Continuing Project—Your Financial Journey: Students develop, implement, and monitor a personal spending plan and walk away with a way to manage day-to-day financial questions and concerns.

Continuing Case: Students follow “Tarek’s” progress from college graduate through marriage and apply their learning by helping him make wise financial decisions along the way.

New! Continuing Case: Kim and Chris’s Financial Journey is an additional continuing case option to the Continuing Case: Tarek’s Financial Journey that appears in the course. This case provides students’ with an alternative non-traditional case study to help look at the financial journey from a new perspective.

Calculating the Cost of Life’s Financial Journey: This exercise provides students with fun, hands-on calculation questions that build confidence in analyzing data, calculating the time value of money, and other basic calculations.

Planning for the Future: Mini-case scenarios help students solve true-to-life problems and give them experience dealing with potential situations they may face in the future.

Engaging, interactive, and personalized learning.

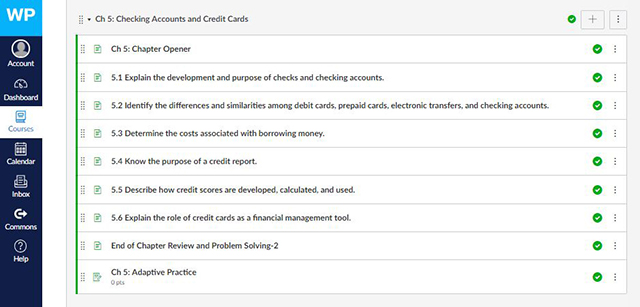

Adaptive Assignments: Ignite students’ confidence to persist so that they can succeed in their courses and beyond. By continuously adapting to each student’s needs and providing achievable goals with just-in-time instruction, Adaptive Assignments close knowledge gaps to accelerate learning.

Peer-to-Peer Videos Make Financial Literacy Relevant: Integrated videos with discussion questions featuring students, peers, and professionals reinforce key concepts from each learning objective and illustrate how financial decisions affect our lives.

Engaging Animations Convey Complex Concepts: Select learning objectives feature a narrated animation reviewing all concepts included in reading materials, allowing students to read, watch, or both.

Digital Infographics and Interactive Figures Reinforce Critical Thinking: Approachable infographics increase student understanding of complicated topics, while magazine-style self-assessments engage students with content and provide opportunities for critical thinking.

Flashcards and Crossword Puzzles help students study and master key vocabulary and complex concepts

Flexible and modular course format for easy course design and delivery.

Topical assessment with each learning objective gives instructors the freedom and flexibility to cover only the content that matters most to their students.

The flexibility this course offers supports many delivery modes, including hybrid, in-person teaching, and online.

Modular chapter format can be suitable for a 1-credit hour or dual enrollment course.

What’s New to This Course

- Adaptive Assignments, powered by Knewton, support instructors in creating assignments with intent and help students master course concepts. By continuously adapting to each student’s needs and providing achievable goals with just-in-time instruction, Adaptive Assignments bridge knowledge gaps to accelerate learning.

- New! Financial Calculator Solution Walkthrough Videos with personal finance instructor Dr. Michael Thomas introduce the basics of working with a financial calculator. Students work through four end-of-topic homework questions, providing 24/7 just-in-time support and problem-solving skills for time-value-of-money problems.

- New! Gradable Excel Questions for selected end-of-topic and end-of-chapter homework questions are available for instructors to assign to facilitate student practice of Excel skills in the context of solving personal finance questions.

- New! Combo Course: You Got This! The Real Skills You Need for Career Success. Ten modules are included in this innovative, all-digital course, which addresses core content topics such as critical thinking, communication, emotional intelligence, and intercultural aptitude. The combo course integrates original videos, quizzes, animated simulations, and career resources seamlessly into your Grable, Introduction to Personal Finance, 2nd edition course. Modeled after the National Association of Colleges and Employers (NACE) eight career readiness competencies, this combo course helps students build the skills they need to succeed in today’s workplace.

Chapter-by-Chapter Changes

- Chapter 1: New coverage of the COVID-19 pandemic on human and social capital in Section 1.2.

- Chapter 2: Revised math symbology, division symbol changed from “/” to “÷” in textbook time-value-of-money explanations, equations, and illustrations.

- Chapter 3: Revised explanation of hours tracking requirements for salaried and hourly-wage employees in Section 3.2. Updated occupations average wage data, refundable tax credits information and Social Security funding status data.

- Chapter 4: Expanded explanation of American Opportunity Credit and Lifetime Learning Credit, and temporary 2021 Child Tax Credit changes. Refined explanations related to self-employment throughout, including calculating self-employment taxes in Section 4.5.

- Chapter 5: New, expanded discussion of Person-to-Person (P2P) lending (e.g., Venmo, Zelle, etc.) in Section 5.2. New coverage of Beware of Rule of 78 loans in Section 5.3. New, updated rules for credit cards and credit scores (FICO) and expanded recommendations for improving your credit score, in Section 5.5.

- Chapter 6: Expanded coverage of student loan repayment options in Section 6.3. New Section 6.4 Approaches to College Education Funding, expanding support for students and parents on college financing. New expanded coverage of Types of Housing in Section 6.7.

- Chapter 7: New coverage of Where to Bank discussing online banking (Apple, Google, FNBO Direct) in Section 7.3. New coverage on the impact of the COVID-19 pandemic on financial fraud and updated data in The Facts of Identity Theft, in Section 7.7.

- Chapter 8: New coverage of SPAC (special purpose acquisition company) in An Alternative When Creating a Stock in Section 8.1. New discussion of mobile stock trading apps (Betterment, Marcus, etc.) and free stock trading in Sections 8.1 and 8.2. New coverage of Institutional Class shares in Section 8.4. New coverage of FOMO (Fear of Missing Out) and investment hype in Section 8.11.

- Chapter 9: New coverage of the Health Insurance Marketplace in Section 9.2. New coverage of Insuring Other Property (e.g., a boat, motorcycle, motor home, etc.) in Section 9.6.

- Chapter 10: New coverage about what job sectors may still offer pensions (e.g., government, public education) in Section 10.1. New, including penalty exceptions examples for early retirement account withdrawal (e.g., first home purchase, birth or adoption of a child, etc.) in Section 10.2.

John Grable teaches and conducts research in the Certified Financial Planner™ Board of Standards Inc. undergraduate and graduate programs at the University of Georgia where he holds an Athletic Association Endowed Professorship. Prior to entering the academic profession, he worked as a pension/benefits administrator and later as a registered investment adviser in an asset management firm. Dr. Grable has served the financial planning profession as the founding editor of the Journal of Personal Finance and co-founding editor of the Journal of Financial Therapy and the Financial Planning Review. He is best known for his work in financial literacy and education, financial risk-tolerance assessment, behavioral financial planning, and evidence-based financial planning. He has been the recipient of numerous research and publication awards and grants and is active in promoting the link between research and financial planning practices where he has published over 150 refereed papers, co-authored several textbooks, co-authored a financial planning communication book, and co-edited a financial planning and counseling scales book. Since earning his Ph.D., Dr. Grable has served on the Board of Directors of the International Association of Registered Financial Consultants (IARFC) as treasurer and president for the American Council on Consumer Interests (ACCI) and as treasurer and board member for the Financial Therapy Association. He has received numerous awards, including the prestigious Cato Award for Distinguished Journalism in the Field of Financial Services, the IARFC Founders Award, the Dawley-Scholer Award for Faculty Excellence in Student Development, and the ACCI Mid-Career Award. He currently writes an economics and investing column for the Journal of Financial Service Professionals and provides research and consulting services through the Financial Planning Performance Lab.

Lance Palmer received his bachelor’s and MBA degrees from the University of Utah and his doctorate from Utah State University. He is a co-founder of the University of Georgia (UGA) Financial Planning major where he continues to teach courses in financial planning with a focus on tax planning. He is a Certified Financial Planner™ professional. He has served on multiple editorial boards and as president of the Academy of Financial Services. He was selected as a 2007 Lilly Teaching Fellow and received the 2010 Richard B. Russell Excellence in Undergraduate Teaching Award and the 2013 Engaged Scholar Award. Working closely with Georgia United Credit Union, Dr. Palmer has helped to expand the service-learning Volunteer Income Tax Assistance program in Athens, Georgia. Under his supervision, students studying financial planning and accounting complete approximately 1,300 tax returns for families in the local community each year. His students also provide thousands of hours of financial education and planning assistance to tax filers during the tax preparation process. Dr. Palmer is also affiliated with the University of Georgia ASPIRE Clinic. Dr. Palmer’s research has focused on motivating savings among low and moderate-income tax filers through brief intervention strategies. His research has also explored how service-learning participation helps to prepare students for professional work.

1. Beginning Your Financial Journey: The Interior Finance Point of View

2. Tools for Your Financial Journey

3. Earnings and Income: The Building Blocks of Your Financial Journey

4. Personal Taxation

5. Checking Accounts, Credit Scores, and Credit Cards

6. Loans and Housing Decisions

7. The Foundation of Savings

8. Investments

9. Risk Management: The Role of Insurance

10. Planning for the Long-Term Future: Retirement and End-of-Life Directives