Introduction to Personal Finance: Beginning Your Financial Journey, 3rd Edition

By John Grable and Lance Palmer

Every financial decision we make impacts our lives. Introduction to Personal Finance: Beginning Your Financial Journey, 3rd Edition helps students realize the life journey they envision for themselves without the constant distraction of financial stresses. To help students launch their financial journey, they learn to create a clear roadmap through real-world, interactive resources including continuing cases, application-based exercises, and reflection that enable them to learn how to avoid early financial mistakes and secure a strong foundation for the future.

In addition, students develop a strong understanding of important and current topics including the latest income tax and retirement laws, economic terms and models, benefits associated with self-employment, and a foundation needed to deal with the changing economic landscape. With a focus on robust assessment, video-based learning, Excel and data analytics tools, and budgeting projects, students will develop a clear understanding of personal finance best practices and develop the skillset needed to move them into the fast lane of their lifetime financial journey.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Learn Personal Finance Concepts Efficiently

Financial Calculator Solution Walkthrough Videos provide 24/7, just-in-time homework help and introduce students to the basics of working with a financial calculator. In each video, students walk through end-of-topic homework questions and develop the problem-solving skills needed to approach various time-value-of-money problems.

Adaptive Assignments ignite students’ confidence to persist so they can develop critical skills. By continuously adapting to each students’ needs and providing achievable goals with just-in-time instruction, Adaptive Assignments close knowledge gaps through scaffolded learning. Powered and refined by the Knewton Adaptive Engine, with more than 15 million users, this new assignment type gives instructors the flexibility and control to create targeted adaptive experiences that match their teaching preferences. With actionable analytics to support student and class intervention, Adaptive Assignments makes teaching and learning more efficient than ever.

Develop Practical Life Skills Through Application

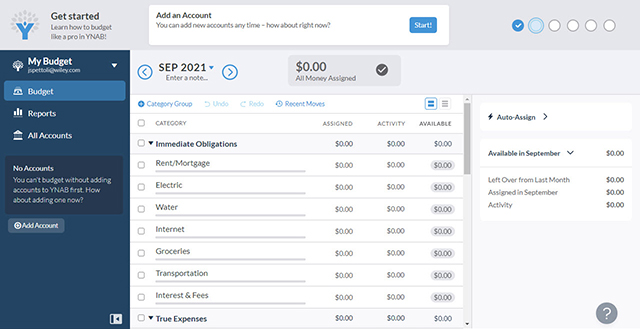

The YNAB Budgeting Project leverages the award-winning You Need a Budget app and helps students set up a personal budget with video guidance from experts to get them started on their journey to reach their financial goals.

The Calculating the Cost of Life’s Financial Journey exercise provides students with hands-on calculation questions that build confidence in analyzing data, calculating the time value of money, and other important calculations.

Build Real-World Connections with Case-Based Learning

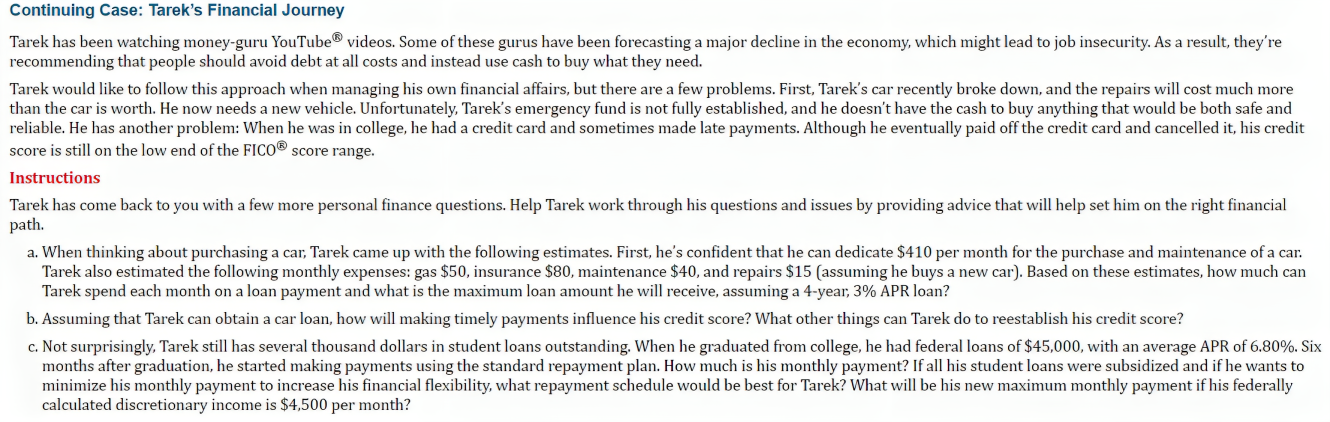

Tarek’s Financial Journey is a continuing case that follows Tarek’s life progress from college graduate through marriage and allows students to apply their learning from the course by helping him make wise financial decisions along the way. Kim and Chris’ Financial Journey, an additional continuing case designed to complement Tarek’s Financial Journey, provides students with an alternate, non-traditional case study to explore the financial journey from a different perspective.

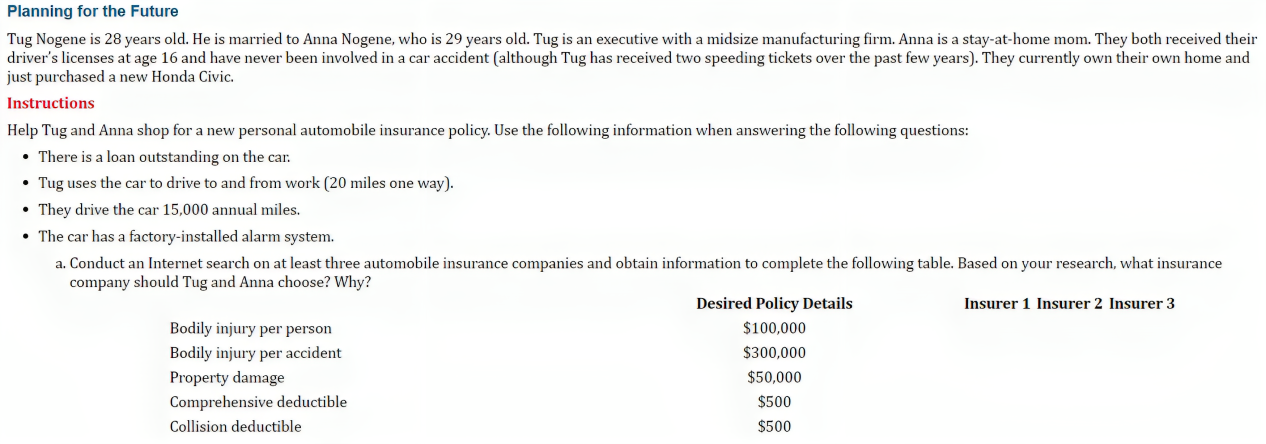

Planning for the Future mini case scenarios help students solve true-to-life problems and give them experience dealing with potential situations they may face in the future.

Incorporate Interactive and Video-Based Learning

Peer-to-Peer Videos with integrated discussion questions help make financial literacy relevant. These videos feature students, peers, and professionals and reinforce key concepts from each learning objective, illustrating how financial decisions impact our lives.

Animations, available for select learning objectives, review key concepts and provide an engaging and interactive way for students to learn complex topics.

Develop Data Analytics and Excel Skills

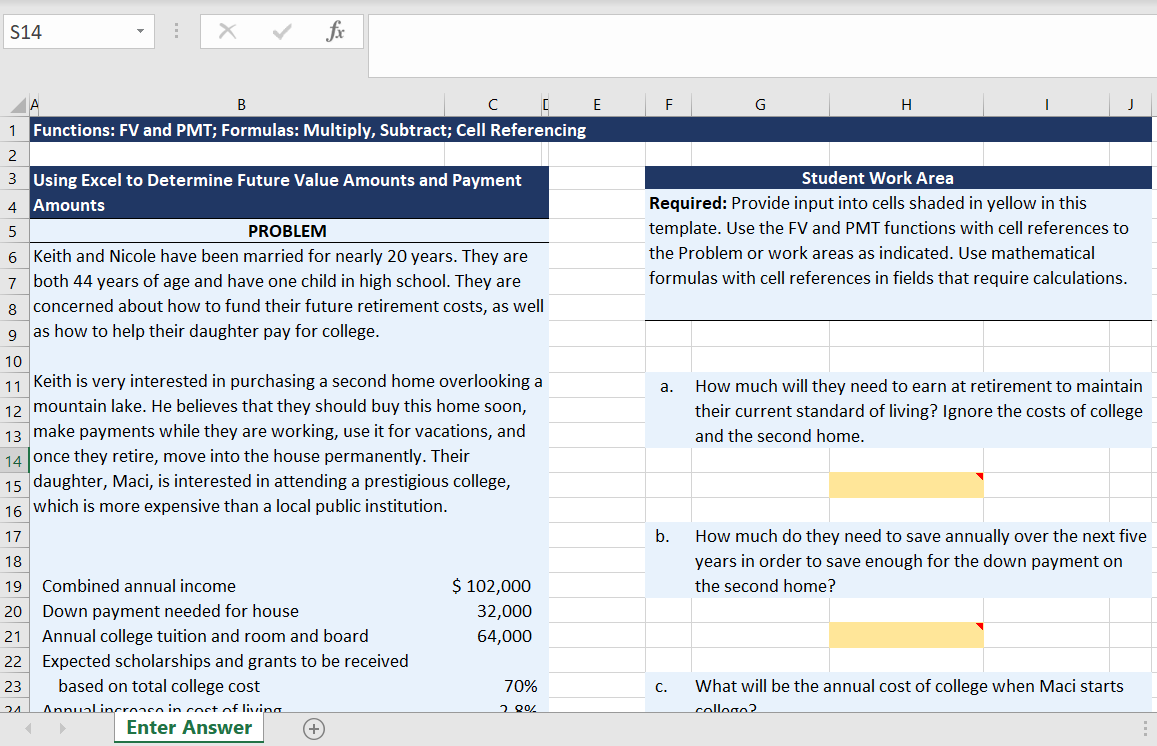

Gradable Excel Assignments develop the Excel knowledge and skills students need by giving them the opportunity to practice using formulas and functions to complete specific exercises in a real Microsoft Excel worksheet. With exercises based on questions from the book, automatic grading, and immediate and detailed cell-level feedback, students build key skills needed to be competitive in today’s job market while enhancing their understanding of key course concepts.

Developed in partnership with the Business-Higher Education Forum (BHEF), the Data and Analytics Business Module develops the data analytics knowledge students need to understand why data analytics is important and how it’s changing the workforce. Students work through interactive bite-sized lessons, case studies, real data sets, videos, articles, and auto-graded quizzes to ensure they develop a strong understanding of the key areas and topics related to data analytics.

Incorporate Cutting-Edge Topics

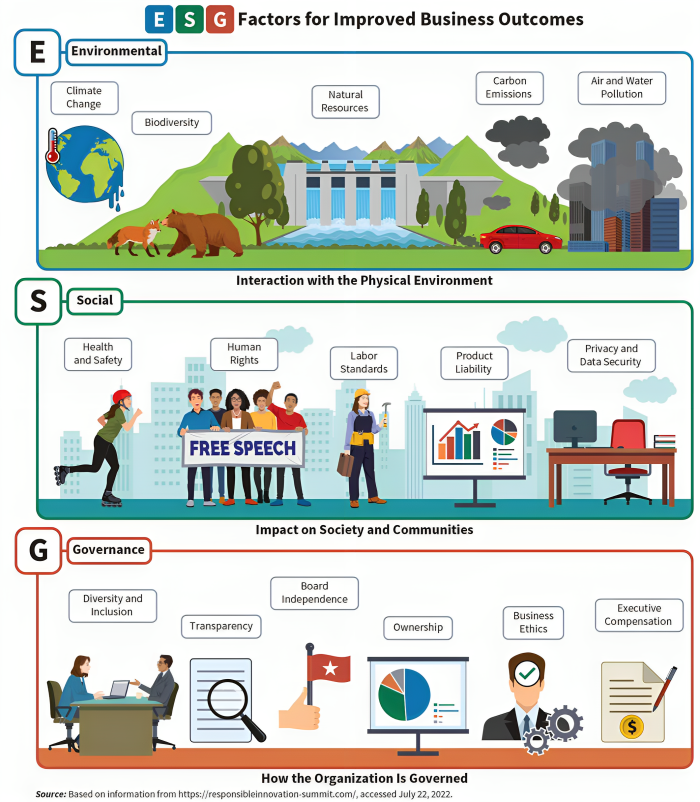

Introduce your students to ESG in the business context with the WileyPLUS ESG Module, designed to help students understand what ESG is, why it’s important, and how it’s changing the modern accounting and business world. Students work through each pillar of ESG through lessons on Environment, Social, Governance, and Reporting, along with relatable business scenarios with recognizable companies, access to real-world sample reports, and assignable quiz questions.

What’s New to the 3rd Edition

- New interactive eTextbook experience provides in-line practice at the point of learning to encourage students to check their understanding after each learning objective and get active in their reading experience.

- Updated assessment questions reflect changes in the textbook and the most recent financial data.

- New WileyPLUS ESG Module to expose students to one of the leading topics changing accounting and business practices in industry. Students work through lessons on each pillar of ESG, which include relatable business scenarios with recognizable companies, access to real-world sample reports, and assignable quiz questions.

Content Changes

- Updated and revised 2024 tax numbers.

- Updated topics and applicable material improves clarity and inclusivity, as well as reflects the most recent financial data.

- Updated information on individual income tax, retirement law changes, and new saving and investment alternatives, including cryptocurrencies and non-fungible tokens, has been added.

- New topics and discussion points on economic terms and models, the benefits associated with self-employment, and information to help individuals deal with the changing economic landscape.

John Grable teaches and conducts research in the Certified Financial Planner® Board of Standards Inc. undergraduate and graduate programs at the University of Georgia, where he holds an Athletic Association Endowed Professorship. Prior to entering the academic profession, he worked as a pension/benefits administrator and later as a Registered Investment Adviser in an asset management firm. Dr. Grable has served the financial planning profession as the founding editor of the Journal of Personal Finance and co-founding editor of the Journal of Financial Therapy and Financial Planning Review. He currently serves as the editor of Financial Services Review. Dr. Grable is best known for his work in the areas of financial literacy and education, financial risk-tolerance assessment, behavioral financial planning, and evidence-based financial planning. He is active in promoting the link between research and financial planning practice and has published over 150 refereed papers, co-authored several textbooks, co-authored a financial planning communication and counseling book, and co-edited a financial planning and counseling scales book. Since earning his doctorate, Dr. Grable has served on the Board of Directors of the International Association of Registered Financial Consultants (IARFC), as Treasurer and President for the American Council on Consumer Interests (ACCI), and as Treasurer and board member for the Financial Therapy Association. He has received numerous awards, including the prestigious Cato Award for Distinguished Journalism in the Field of Financial Services, the IARFC Founders Award, the Dawley-Scholer Award for Faculty Excellence in Student Development, and the ACCI Mid-Career Award. Dr. Grable was the first inductee into the Financial Therapy Association’s Hall of Fame.

Lance Palmer received his bachelor’s and MBA degrees from The University of Utah and his doctorate from Utah State University. He is a co-founder of the University of Georgia (UGA) financial planning program, where he continues to teach and conduct research with a focus on tax planning and financial behavior change. Dr. Palmer holds the Janette McGarity Barber Distinguished Professorship and teaches both undergraduate and graduate financial planning and personal finance courses within the UGA financial planning program. He is active in research-based financial education through¬out Georgia and the country, and collaborates on the design, implementation, and evaluation of personal finance education interventions delivered in a variety of settings. He is a Certified Financial Planner® professional and a Certified Public Accountant (UT). He has served on multiple editorial boards and as President of the Academy of Financial Services. He was selected as a Lilly Teaching Fellow and received the Richard B. Russell Excellence in Undergraduate Teaching Award, the Engaged Scholar Award, the Service-Learning Research Excellence Award, and the Meigs Distinguished Teaching Professorship. Dr. Palmer has helped to expand the service-learning Volunteer Income Tax Assistance program throughout Georgia. Under this program, students studying financial planning and accounting complete thousands of tax returns for families in the local community each year and provide thousands of hours of financial education and planning assistance to tax filers during the tax preparation process. The initiative seeks to build wealth among low-income individuals and families through financial education, coaching, goal development, and tax-time savings interventions.

Chapter 1: Beginning Your Financial Journey: The Interior Finance Point of View Chapter 2: Tools for Your Financial Journey Chapter 3: Earnings and Income: The Building Blocks of Your Financial Journey Chapter 4: Personal Taxation Chapter 5: Checking Accounts, Credit Scores, and Credit Cards Chapter 6: Loans and Housing Decisions Chapter 7: The Foundation of Savings Chapter 8: Investments Chapter 9: Risk Management: The Role of Insurance Chapter 10: Planning for the Long-Term Future: Retirement and End-of-Life Directives