Introduction to Corporate Finance 5th Edition

By Laurence Booth, Sean Cleary and Ian Rakita

Booth, Introduction to Corporate Finance, 5th Edition is the only uniquely Canadian course to give students perspective, history, and richness to concepts. The course builds financial statements from the ground up while referencing them later in the chapter to establish a stronger connection between corporate finance decision making and the balance sheet. Our robust variety of videos also provide insight into the world of finance, connecting concepts learned in the classroom to the profession.

Introduction to Corporate Finance, 5th Edition has become even more user-friendly and engaging and continues to provide students with the most thorough, accessible, accurate, and current coverage of the theory and application of corporate finance within a uniquely Canadian context.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

WileyPLUS offers students more opportunities for engagement through multiple video resources.

- Corner Suite Videos feature author interviews with prominent leading professionals.

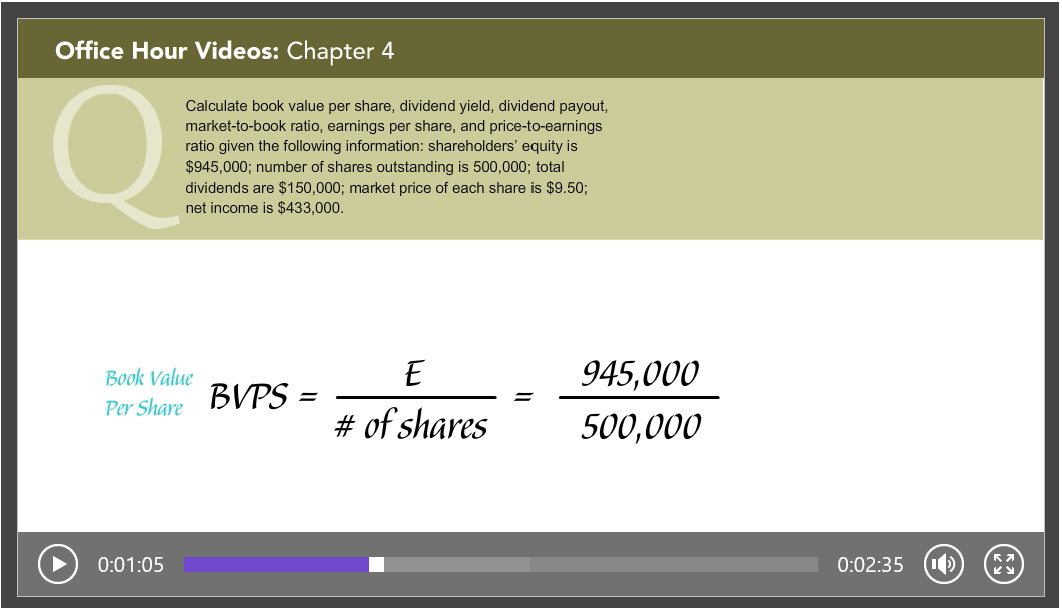

- Office Hour Videos provide guided, step‐by‐step instructions for solving sample problems from the textbook.

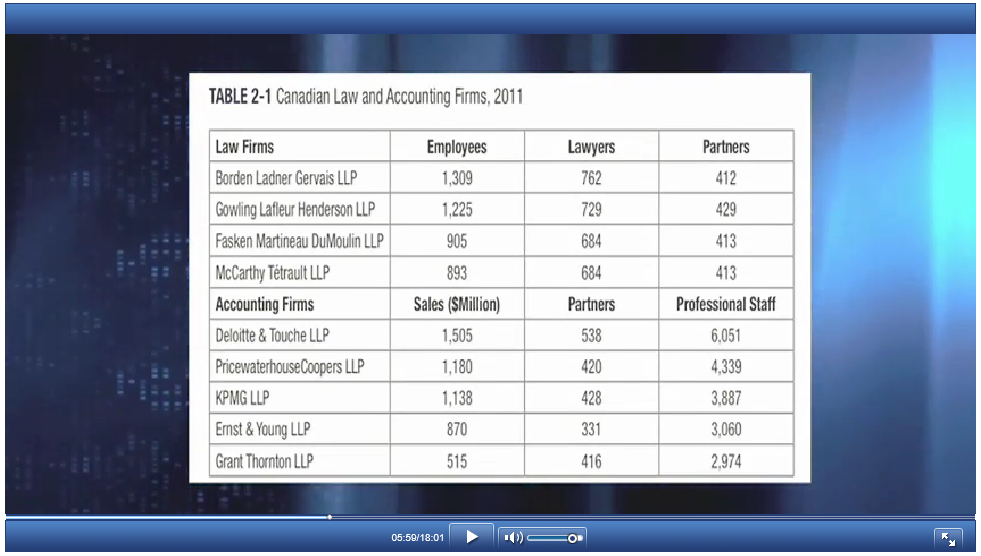

- Author Video Tutorials walk students through examples to help them master core concepts and use current and relevant financial news to illustrate and apply key topics.

NEW Bloomberg Video Assignments

Bloomberg Video Assignments include a set of graded video activities to support cutting-edge video content from Bloomberg. The corresponding video activities challenge students to tie content directly to real-world business scenarios and offer them an applied, engaging learning experience to supplement their corporate finance course.

What’s New

- Math Skills Review offers just in time math and statistics refreshers to help students master the skills they need to be successful in this course.

- Mini Cases help assess students’ understanding of multiple concepts.

- Real-world company statements throughout the text help students link theory to practice.

- Wide variety of algorithmic practice and homework to help students master concepts.

- Finance in the News boxes have been updated and reflect current, topical issues.

- More than 70 new problems added to the end of chapter material.

- Lessons to be Learned boxes have been updated as needed.

- End of chapter material updated to reflect content changes and changes to years/dates.

- Concept Review Questions: At the end of each major section, questions are provided to help students check their understanding before moving on.

- Ethics and Corporate Governance: Found in various parts of the text, this feature discusses how issues of ethics and corporate governance affect corporations today. These features include questions to help launch in-class analysis and discussion.

- Financial Calculator Keystrokes: All relevant demonstration problems include actual keystrokes for the TI BA II Plus calculator.

- NEW Gradable Excel worksheet activities are included in this course.

Laurence Booth, DBA, MBA, MA (Indiana University); BS (London School of Economics), is Professor of Finance and holds the CIT chair in structured finance at the Rotman School of Management, University of Toronto. His major research interests are in corporate finance and the behaviour of regulated industries. He has published over 70 articles in numerous journals including Journal of Finance and Journal of Financial and Quantitative Analysis, has co-authored a textbook on international business and two on corporate finance, and is on the editorial board of several academic journals.

At the University of Toronto since 1978, Professor Booth has taught graduate courses in business finance, international financial management, corporate financing, mergers and acquisitions, financial management, financial markets, applied asset management, and financial theory, as well as many short executive courses. He has been the primary doctoral supervisor for 16 students at the University of Toronto. His advice is frequently sought by the media, and he has appeared as an expert financial witness in both civil cases and before various regulatory tribunals in Canada.

Sean Cleary, CFA, is the BMO Professor of Finance at the Smith School of Business, Queen’s University. Dr. Cleary holds a PhD in finance from the University of Toronto, an MBA, is a Chartered Financial Analyst (CFA) charter holder, and is a former board member of both the Atlantic Canada and Toronto CFA societies. He has also completed the Professional Financial Planning Course (PFPC), the Canadian Securities Course (CSC), and the Investment Funds Institute of Canada (IFIC) Mutual Fund Course.

Dr. Cleary has taught numerous university finance courses as well as courses and seminars in many programs designed to prepare students to write exams for all three levels of the CFA program and the CSC. He is the Canadian author of the first three editions of Investments: Analysis and Management and the co-author of the sixth edition of Finance in a Canadian Setting, both published by John Wiley & Sons Canada, Ltd. He is also the author of the first four editions of The Canadian Securities Exam Fast Track Study Guide, also published by Wiley.

Dr. Cleary has published numerous research articles in various journals, including Journal of Finance, Journal of Financial and Quantitative Analysis, Financial Management, Journal of Banking and Finance, and Journal of Financial Research among others. He has received several major research grants from the Social Sciences and Humanities Research Council of Canada (SSHRC). He currently serves as Associate Editor (Finance) at Canadian Journal of Administrative Sciences and Associate Editor for European Journal of Finance.

Dr. Cleary frequently appears in the media on television, on the radio, and in newspapers.

Ian Rakita, CFA, started teaching in the Department of Finance at Concordia University’s John Molson School of Business in 1993 after extensive industry experience. He received his Bachelor of Science degree from McGill University, where he majored in mathematics, and his MBA from Concordia University. He earned his PhD from Concordia in 2000. During 1997–1998 he taught at Wilfrid Laurier University in Waterloo, Ontario, where he received a commendation for teaching excellence. Dr. Rakita teaches courses at the undergraduate and graduate level in corporate finance, fixed income securities, and derivatives. He has also taught courses in operations research and business statistics. His research interests are in the microstructure of new and secondary equity offerings as well as the efficiency of Canadian capital markets.

Dr. Rakita has published articles in Journal of Banking and Finance, Multinational Finance Journal, The Engineering Economist, Canadian Investment Review, and Journal of the Operational Research Society. He is the only two‐time winner of the Gold Prize for outstanding paper awarded in an annual contest sponsored by the Montreal Society of Financial Analysts, where he has also served on the board of directors. Dr. Rakita completed the requirements for the Chartered Financial Analyst designation in 2001. He is currently the Director of the MBA program at Concordia University’s Goodman Institute of Investment Management. This specialized MBA program links the requirements of the CFA curriculum with the academic requirements of a traditional MBA degree.

PART 1: THE FINANCIAL ENVIRONMENT

Chapter 1: An Introduction to Finance

Chapter 2: Business (Corporate) Finance

PART 2: FINANCIAL ANALYSIS TOOLS

Chapter 3: Financial Statements

Chapter 4: Financial Statement Analysis and Forecasting

PART 3: VALUATION BASICS

Chapter 5: Time Value of Money

Chapter 6: Bond Valuation and Interest Rates

Chapter 7: Equity Valuation

PART 4: PORTFOLIO AND CAPITAL MARKET THEORY

Chapter 8: Risk, Return, and Portfolio Theory

Chapter 9: The Capital Asset Pricing Model (CAPM)

Chapter 10: Market Efficiency

PART 5: DERIVATIVE SECURITIES

Chapter 11: Forwards, Futures, and Swaps

Chapter 12: Options

PART 6: LONG-TERM INVESTMENT DECISIONS

Chapter 13: Capital Budgeting, Risk Considerations, and Other Special Issues

Chapter 14: Cash Flow Estimation and Capital Budgeting Decisions

Chapter 15: Mergers and Acquisitions

Chapter 16: Leasing

PART 7: LONG-TERM FINANCING

Chapter 17: Investment Banking and Securities Law

Chapter 18: Debt Instruments

Chapter 19: Equity and Hybrid Instruments

Chapter 20: Cost of Capital

PART 8: FINANCIAL POLICIES

Chapter 21: Capital Structure Decisions

Chapter 22: Dividend Policy

PART 9: WORKING CAPITAL MANAGEMENT

Chapter 23: Working Capital Management: General Issues

Chapter 24: Working Capital Management: Current Assets and Current Liabilities

Appendix 1

Index