Personal Finance, 3rd Edition

By Vickie Bajtelsmit

Personal Finance, 3rd Edition builds the essential skills and knowledge that will set students on the road to lifelong financial wellness. With a focus on real-world and relatable examples, as well as up-to-date coverage on important topics including student debt, housing, fintech, and AI, students gain the knowledge they need to avoid early financial mistakes and learn how to make connections that can immediately impact their current financial situations.

To help students learn how to set personal financial goals, develop a plan for achieving them, and make informed financial decisions, they work through resources such as the Personal Finance Planner Assignments, integrated case-based learning with discussions, and a variety of ethical issues in practice. In addition, robust assessment, reflection exercises, video-based learning, and Excel and data analytics tools ensure students have a solid understanding of personal finance best practices and can connect with the content on a personal level, improving their engagement and building the skills needed to make strong financial decisions for the future.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Learn Personal Finance Concepts Efficiently

Available within each chapter, Demonstration Problems provide step-by-step directions for applying financial math calculations to specific personal finance problems, with solutions for multiple methods. Demonstration Problem Videos, available within WileyPLUS, feature the author working through the problem using a financial calculator or spreadsheet visual where applicable.

Adaptive Assignments ignite students’ confidence to persist so they can develop critical skills. By continuously adapting to each students’ needs and providing achievable goals with just-in-time instruction, Adaptive Assignments close knowledge gaps through scaffolded learning. Powered and refined by the Knewton Adaptive Engine, with more than 15 million users, this new assignment type gives instructors the flexibility and control to create targeted adaptive experiences that match their teaching preferences. With actionable analytics to support student and class intervention, Adaptive Assignments makes teaching and learning more efficient than ever.

Incorporate Interactive and Video-Based Learning

Innovative interactives help students develop a better understanding of chapter concepts in a fun way. There are several types of activities in each chapter, including personal self-assessments, concept applications, and interactive visual tools.

Peer-to-Peer Videos feature actual students and professionals illustrating the impact of financial decisions and act as a catalyst for deeper classroom discussions.

Develop Data Analytics Skills

Developed in partnership with the Business-Higher Education Forum (BHEF), the Data and Analytics Business Module develops the data analytics knowledge students need to understand why data analytics is important and how it’s changing the workforce. Students work through interactive bite-sized lessons, case studies, real data sets, videos, articles, and auto-graded quizzes to ensure they develop a strong understanding of the key areas and topics related to data analytics.

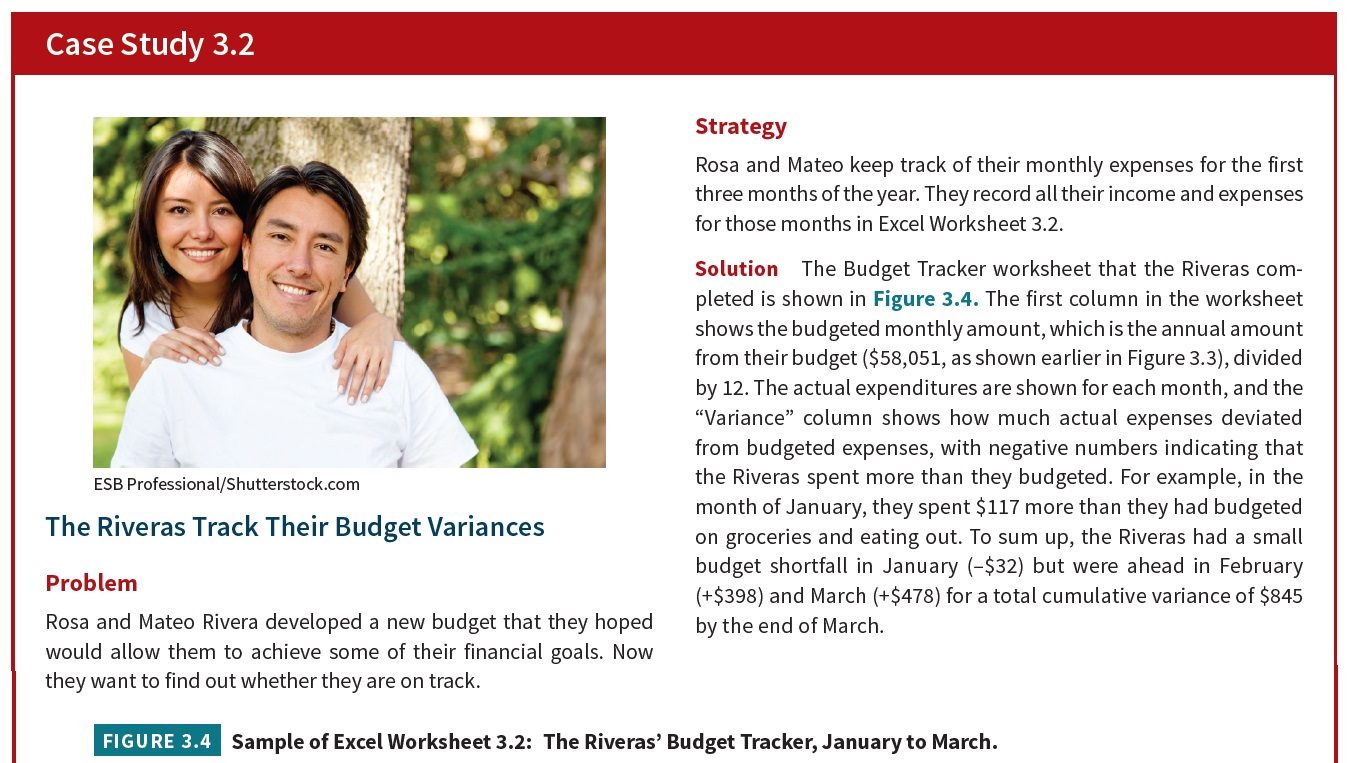

Build Real-World Connections with Case-Based Learning

Integrated within the content, students work through a variety of mini cases that spotlight a personal finance decision for an individual or family. These cases allow students to practice applying their new conceptual and analytical knowledge to realistic problems, with detailed solutions and discussions. Students also have access to the Lifelong Planning continuing case within WileyPLUS, which features Carlo and Grace Nelson as they navigate various financial scenarios throughout their lives.

Incorporate Cutting-Edge Topics

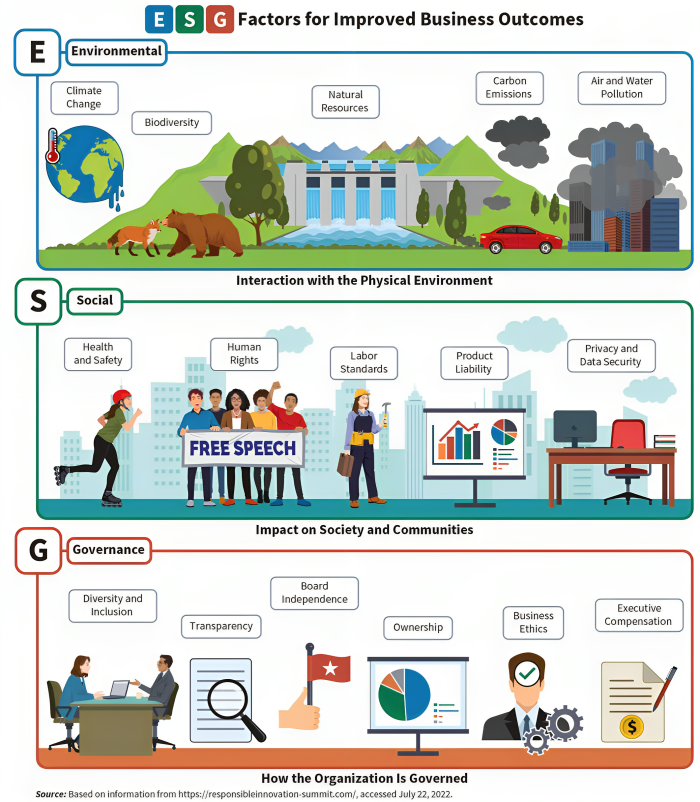

Introduce your students to ESG in the business context with the WileyPLUS ESG Module, designed to help students understand what ESG is, why it’s important, and how it’s changing the modern accounting and business world. Students work through each pillar of ESG through lessons on Environment, Social, Governance, and Reporting, along with relatable business scenarios with recognizable companies, access to real-world sample reports, and assignable quiz questions.

What’s New to the 3rd Edition

- New interactive eTextbook experience provides in-line practice at the point of learning to encourage students to check their understanding after each learning objective and get active in their reading experience.

- New Peer-to-Peer Videos feature real students and professionals illustrating the impact of financial decisions.

- New Online Calculator Demonstration Videos highlight particularly useful online calculators and walk students through how to use them to make financial decisions that are relevant to the chapter content.

- New Gradable Excel Assignments develop the Excel knowledge and skills students need by giving them the opportunity to practice using formulas and functions to complete specific exercises in a real Microsoft Excel worksheet.

- New algorithmic end-of-chapter and test bank questions provide more flexibility in how educators assess their students.

- New WileyPLUS ESG Module to expose students to one of the leading topics changing accounting and business practices in industry. Students work through lessons on each pillar of ESG, which include relatable business scenarios with recognizable companies, access to real-world sample reports, and assignable quiz questions.

Content Changes

- Updated and revised 2024 tax numbers.

- New Chapter Plan and Summary feature functions as a student roadmap and include a table to identify the chapter learning objectives, topics covered in each section, and Demonstration Problems within the chapter.

- New reflection questions integrated throughout the content encourage students to reflect on their own financial situations and think more deeply about course material.

- New Fintech Alert features dive into relevant fintech topics and provide insight into what kind of fintech is out there as well as how to use it safely and effectively

- New Money Psychology features explore the psychology behind the important personal finance decisions and situations individuals will face throughout their lives.

- New Ethics in Action features explore the ethical implications of financial decision making.

- New Lifelong Planning continuing case within WileyPLUS features Carlo and Grace Nelson as they navigate various financial scenarios throughout their lives.

- Updated Instructor Manual includes new lesson plans, lecture ideas, and web resources.

- New Wiley eReader Study Sessions allow students to build and customize their own quizzes and flashcards based on keywords and concepts from the book.

- Updated art enhances accessibility, diversity, equity, and inclusion.

Vickie Bajtelsmit is a Professor Emerita from the Department of Finance and Real Estate at Colorado State University, where she taught a wide variety of undergraduate and graduate classes, including personal finance, financial planning, risk management and insurance, real estate, employee benefits, and investments. She earned her Ph.D. from the University of Pennsylvania’s Wharton School of Business and a J.D. from Rutgers University School of Law. In addition to her previous personal finance books, A Busy Woman’s Guide to Financial Freedom (2001), Personal Finance: Skills for Life (2006), Personal Finance: Managing Your Money and Building Wealth (2008), and the two previous editions of Personal Finance (2016, 2020), she has authored numerous articles in academic and professional journals, focused on personal finance issues related to retirement, insurance, investments, and real estate. Previous professional accomplishments include service as the President of the American Risk and Insurance Association (2010), President of the Risk Theory Society (2010), and President of the Academy of Financial Services (2004) and service on the CFP-Board committee that developed the model curriculum for financial planning programs. Vickie is proud to have chaired the committee that revised the national curricular standards for K-12 personal finance education in 2021, co-sponsored by the Coalition for Economic Education and the Jump$tart Coalition for Personal Financial Literacy. She is an Associate Editor for several academic journals and participates actively in several Society of Actuaries research groups.

Chapter 1: The Financial Planning Process Chapter 2: Financial Planning Tools: Personal Financial Statements and the Time Value of Money Chapter 3: Budgeting and Cash Management Chapter 4: Tax Planning Chapter 5: Managing Credit: Credit Cards and Consumer Loans Chapter 6: Making Automobile and Housing Decisions Chapter 7: Insuring Cars and Homes Chapter 8: Life Insurance and Long-Term Care Planning Chapter 9: Employee Benefits: Health, Disability, and Retirement Plans Chapter 10: Saving for Distant Goals: Retirement and Education Funding Chapter 11: The Fundamentals of Investing Chapter 12: Investing in Stocks and Bonds Chapter 13: Investing in Mutual Funds and Real Estate Chapter 14: Estate Planning