Survey of Accounting, 3rd Edition

By Paul Kimmel, Jerry J. Weygandt, Jill Mitchell

Provide future business professionals with a practical introduction to financial and managerial accounting without the use of debits and credits. With its unique focus on building students’ decision-making skills and emphasis on financial statements, Survey of Accounting, 3rd Edition meaningfully integrates data analytics and the importance of using accounting information in real-world decision-making. Adaptive practice opportunities and engaging real-world industry examples and videos strengthen student understanding of accounting concepts and illustrate how these are relevant to their everyday lives and future careers in business and accounting.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Inspire efficient concept mastery.

Close knowledge gaps and accelerate student learning with new Adaptive Assignments that continuously adapt to each student’s needs with individualized, just-in-time feedback and instruction. Assign as pre-lecture to introduce key concepts and post-lecture for practice.

A powerful tool for an online course, a flipped classroom, or assigned in a regular lecture class, Interactive Tutorials provide a guided and active learning experience for students. Interactive tutorial assignments are comprehensive, customizable, and assignable for optimal flexibility.

Activate knowledge application with real-world context.

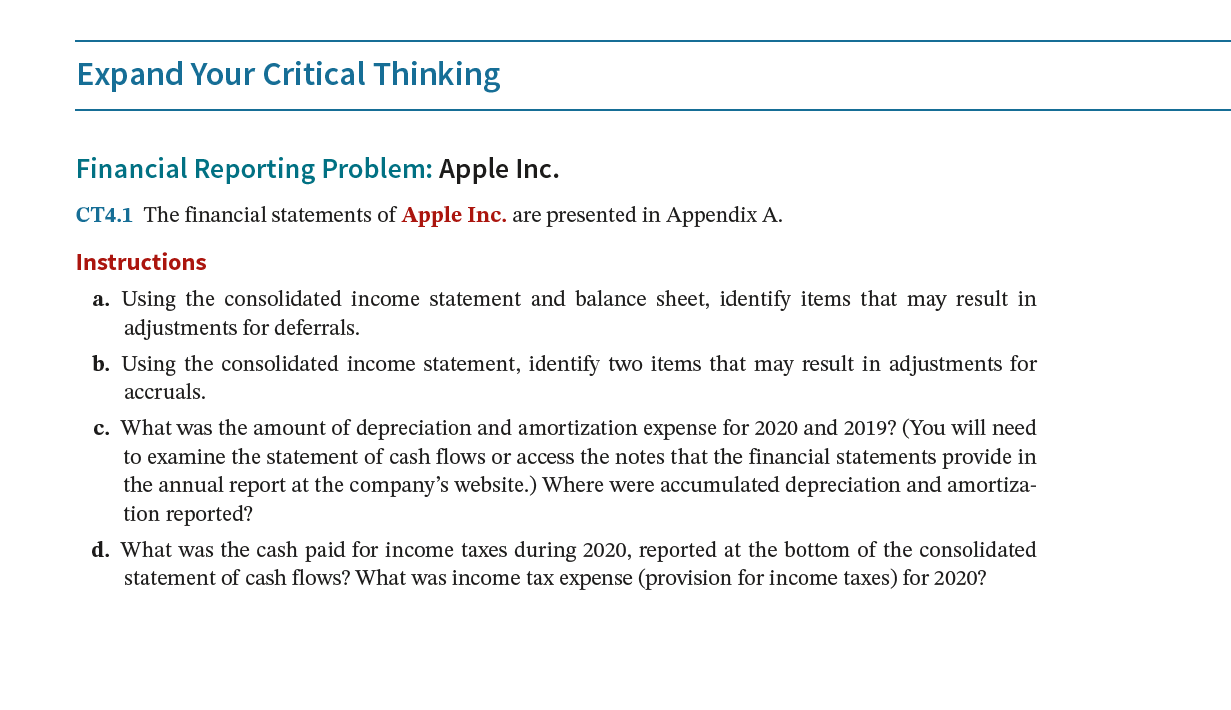

Ground student understanding in Real Financial Statements and Financial Reporting Problems and Comparative Analysis Problems that are based on financial statements for companies including Apple, Columbia, and Under Armour.

Introduce students to business challenges with Real-World Company Videos that feature small businesses and larger companies and illustrate how business owners apply accounting concepts in real-time.

Help students understand the importance of sustainability and corporate Environmental, Social, and Governance (ESG) reporting with ESG Insight Boxes, Critical Thinking Cases, and chapter discussions.

Cultivate the data analytics and problem-solving skills students need for career success.

Provide students with the opportunity to see how to use data analytics to solve realistic business challenges with Data Analytics in Action:

Develop problem-solving skills with. Excel-Based Problems that ask students analyze and report information for business decisions, supporting by videos that provide guidance to perform the Excel skills students need to solve the problems.

Help students interpret visualizations and think critically about data with PowerBI and Tableau Visualizations, accompanied by assignable questions.

Gradable Excel Questions with enhanced functionality provide an opportunity to practice Excel skills in the context of solving chapter accounting problems in a real Microsoft Excel worksheet.

Provide confidence-building practice opportunity with hundreds of algorithmic Auto-graded assignments, supported with author-created Solution walk-through videos that give step-by-step instruction on how to complete problems like those in the text.

Key Resources & Features

- Interactive Tutorials provide voice-guided topic review of each learning objective with integrated self- assessment exercises that check student understanding.

- Infographics and illustrations throughout offer visualization of concepts to provide alternative ways of learning and to strengthen student understanding.

- Real-World Company Videos feature small businesses and larger companies, with assignable questions.

- Data-Analytics in Excel videos provide step-by-step guidance to perform the Excel skills students need to solve the problems.

- Analytics in Action end-of-chapter section, include data visualization discussion and assessment.

- Environmental Social and Governance (ESG) Reporting coverage integrated throughout to highlight its growing importance with ESG Insight Boxes that business examples and scenarios from various perspectives – ethics; investor; international; environmental, social, and governance.

- Accounting-specific Data Analytics Module, with interactive lessons, case studies, and videos, helps develop the professional competencies needed for career success.

- Online Chapter: Statement of Cash Flows

- Online Appendices: Activity-Based Costing, Cost-Volume Profit Analysis, Pricing

- Chapter One Appendix: Careers Opportunities in Accounting

Paul D. Kimmel, Ph.D., CPA, received his bachelor’s degree from the University of Minnesota and his doctorate in accounting from the University of Wisconsin. He is a Senior Lecturer at the University of Wisconsin-Madison and was an Associate Professor at University of Wisconsin – Milwaukee. He was the recipient of the UWM School of Business Advisory Council Teaching Award, the Reggie Taite Excellence in Teaching Award, and a three-time winner of the Outstanding Teaching Assistant Award at the University of Wisconsin. He has public accounting experience with Deloitte & Touche (Minneapolis) and was a recipient of the Elijah Watts Sells Award for Honorary Distinction for his results on the CPA exam. He is a member of the American Accounting Association and the Institute of Management Accountants and has published articles in Accounting Review, Accounting Horizons, Advances in Management Accounting, Managerial Finance, Issues in Accounting Education Journal of Accounting Education, and in other journals. He has authored a number of introductory accounting textbooks, and published papers and given numerous talks on issues related to accounting education.

Jerry J. Weygandt, PhD, CPA, is Arthur Andersen Alumni Emeritus Professor of Accounting at the University of Wisconsin-Madison. He holds a PhD in accounting from the University of Illinois. Articles by Professor Weygandt have appeared in the Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Professor Weygandt is author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of the Accounting Review; he also has served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC). He has served on the FASB task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Professor Weygandt has received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

Jill E. Mitchell, MS, MEd, CIA, is a Lecturer at the McIntire School of Commerce at the University of Virginia. Prior to joining the faculty of McIntire, she was a Professor of Accounting at Northern Virginia Community College (NOVA), where she taught face-to-face, hybrid, and online courses and an adjunct instructor at George Mason University (GMU) where she taught in both undergraduate and graduate programs. She is a past president of the Washington, D.C. Chapter of the Accounting and Financial Women’s Alliance (AFWA), and she served on the board of directors of the Virginia Society of CPAs (VSCPA). She is a member of the American Accounting Association (AAA) and the Institute of Internal Auditors. Jill served on the AAA Education Committee and was the co-chair for the Conference on Teaching and Learning in Accounting (CTLA). Jill was a senior auditor with Ernst & Young’s Business Risk Services practice in Miami, Florida. She is a certified internal auditor and earned an MS in Accountancy from the University of Virginia, an MEd in Instructional Design Technology from George Mason University, and a BBA in Management Information Systems from the University of Georgia. Jill is a recipient of the Outstanding Faculty Award, the Commonwealth’s highest honor for faculty of Virginia’s universities and colleges presented by the State Council of Higher Education for Virginia; the Virginia Community College System Chancellor’s Award for Teaching Excellence; the AFWA’s Women Who Count Award; the AAA Two-Year College Educator of the Year Award; and the AAA/J. Michael and Mary Anne Cook/Deloitte Foundation Prize, the foremost recognition of an individual who consistently demonstrates the attributes of a superior teacher in the discipline of accounting.

CHAPTERS

1 Introduction to Financial Statements

2 A Further Look at The Balance Sheet

3 The Accounting Information System

4 Accrual Accounting Concepts

5 Fraud, Internal Control, and Cash

6 Merchandising Operations and the Multiple-Step Income Statement

7 Reporting and Analyzing Inventory and Receivables

8 Reporting and Analyzing Long-Lived Assets

9 Reporting and Analyzing Liabilities and Stockholders’ Equity

10 Financial Analysis: The Big Picture

11 Managerial Accounting

12 Job Order Costing

13 Cost-Volume-Profit

14 Incremental Analysis

15 Budgetary Planning

16 Budgetary Control and Responsibility Accounting

17 Standard Costs and Balanced Scorecard

18 Planning for Capital Investments

Appendix A. Speciman Financial Statements: Apple Inc.