Intermediate Accounting IFRS, 4th Edition

By Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

The Fourth Edition of Intermediate Accounting: IFRS Edition provides the tools global accounting students need to understand IFRS and how it is applied in practice. The emphasis on fair value, the proper accounting for financial instruments, and the new developments related to leasing, revenue recognition, and financial statement presentation are examined in light of current practice. Global Accounting Insights highlight the important differences that remain between IFRS and U.S. GAAP and discuss the ongoing joint collaboration efforts to resolve them. Comprehensive, up-to-date, and accurate, Intermediate Accounting: IFRS Edition includes proven pedagogical tools, designed to help students learn more effectively and to address the changing needs of this course.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

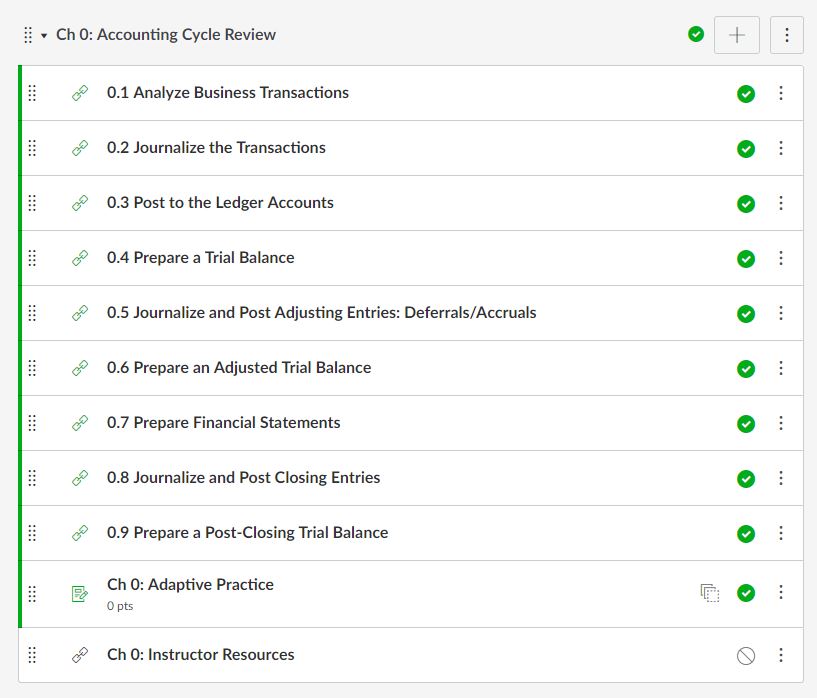

The accounting cycle is continually reinforced.

Assignable Chapter 0 offers adaptive review and practice of each stage of the accounting cycle with reading content, exercises, and problems to provide additional opportunities for both granular and comprehensive accounting cycle practice.

Data Analytics prepares students for the changing profession

WileyPLUS introduces students to an accounting specific data analytics module with interactive lessons, case studies, and videos to help students develop the professional competencies they need to be successful in their careers.

Video homework assistance reaches all types of learners

Terry Warfield, along with additional subject matter experts, provide Solution Walkthrough Videos. These videos align with the most important intermediate accounting concepts and help students answer problems that are similar to ones they will encounter in their homework assignments.

What’s New

- Problem Solution Walkthrough Videos: Terry Warfield and subject matter experts provide videos with step-by-step solutions to problems that are based on similar problems students will find in their homework assignments.

- Video Library: In addition to the problem solution walkthrough videos, students have access to multiple author lecture videos and applied skills videos for each chapter to review key problem-solving techniques from the authors and subject matter experts.

- Wiley Accounting Updates: News articles curated weekly provide students application-based understanding of how the topics relate to the real world. Each article is paired with several discussion questions to encourage students to think critically about the topic in relation to the course content.

Donald E. Kieso, PhD, CPA, received his bachelor’s degree from Aurora University and his doctorate in accounting from the University of Illinois. He has served as chairman of the Department of Accountancy and is currently the KPMG Emeritus Professor of Accountancy at Northern Illinois University. He has public accounting experience with Price Waterhouse & Co. (San Francisco and Chicago) and Arthur Andersen & Co. (Chicago) and research experience with the research division of the American Institute of Certified Public Accountants (New York). He has done post doctorate work as a visiting scholar at the University of California at Berkeley and is a recipient of NIU’s Teaching Excellence Award and four Golden Apple Teaching Awards. Professor Kieso is the author of other accounting and business books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Illinois CPA Society. He has served as a member of the board of directors of the Illinois CPA Society, the AACSB’s Accounting Accreditation Committees, and the State of Illinois Comptroller’s Commission, and he has served as secretary-treasurer of the Federation of Schools of Accountancy and as secretary-treasurer of the American Accounting Association. Professor Kieso is currently serving on the board of trustees and executive committee of Aurora University, as a member of the board of directors of Kishwaukee Community Hospital, and as treasurer and director of Valley West Community Hospital. From 1989 to 1993, he served as a charter member of the national Accounting Education Change Commission. He is the recipient of the Outstanding Accounting Educator Award from the Illinois CPA Society, the FSA’s Joseph A. Silvoso Award of Merit, the NIU Foundation’s Humanitarian Award for Service to Higher Education, a Distinguished Service Award from the Illinois CPA Society, and in 2003, an honorary doctorate from Aurora University.

Jerry J. Weygandt, PhD, CPA, is Arthur Andersen Alumni Emeritus Professor of Accounting at the University of Wisconsin-Madison. He holds a PhD in accounting from the University of Illinois. Articles by Professor Weygandt have appeared in the Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Professor Weygandt is author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of the Accounting Review; he also has served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC). He has served on the FASB task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Professor Weygandt has received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

Terry D. Warfield, PhD, is the PwC Professor in Accounting at the University of Wisconsin-Madison. He received a B.S. and M.B.A. from Indiana University and a Ph.D. in accounting from the University of Iowa. Professor Warfield’s area of expertise is financial reporting, and prior to his academic career, he worked for five years in the banking industry. He served as the Academic Accounting Fellow in the Office of the Chief Accountant at the U.S. Securities and Exchange Commission in Washington, D.C., from 1995–1996. Professor Warfield’s primary research interests concern financial accounting standards and disclosure policies. He has published scholarly articles in The Accounting Review, Journal of Accounting and Economics, Research in Accounting Regulation, and Accounting Horizons, and he has served on the editorial boards of The Accounting Review, Accounting Horizons, and Issues in Accounting Education. He has served as president of the Financial Accounting and Reporting Section, the Financial Accounting Standards Committee of the American Accounting Association (Chair 1995–1996), and on the AAAFASB Research Conference Committee. He also served on the Financial Accounting Standards Advisory Council of the Financial Accounting Standards Board, and he currently serves as a trustee of the Financial Accounting Foundation. Professor Warfield has received teaching awards at both the University of Iowa and the University of Wisconsin, and he was named to the Teaching Academy at the University of Wisconsin in 1995. Professor Warfield has developed and published several case studies based on his research for use in accounting classes. These cases have been selected for the AICPA Professor-Practitioner Case Development Program and have been published in Issues in Accounting Education. He served on the Board of the Illinois CPA Society, then AACSB’s Accounting Accreditation Committees, the State of Illinois Comptroller’s Commission, as secretary-treasurer of the Federation of Schools of Accountancy, and as secretary-treasurer of the American Accounting Association.

Chapter 1. Financial Reporting and Accounting Standards

Chapter 2. Conceptual Framework for Financial Reporting

Chapter 3. The Accounting Information System

Chapter 4. Income Statement and Related Information

Chapter 5. Statement of Financial Position and Statement of Cash Flows

Chapter 6. Accounting and the Time Value of Money

Chapter 7. Cash and Receivables

Chapter 8. Valuation of Inventories: A Cost-Basis Approach

Chapter 9. Inventories: Additional Valuation Issues

Chapter 10. Acquisition and Disposition of Property, Plant, and Equipment

Chapter 11. Depreciation, Impairments, and Depletion

Chapter 12. Intangible Assets

Chapter 13. Current Liabilities, Provisions, and Contingencies

Chapter 14. Non-Current Liabilities

Chapter 15. Equity

Chapter 16. Dilutive Securities and Earnings per Share

Chapter 17. Investments

Chapter 18. Revenue Recognition

Chapter 19. Accounting for Income Taxes

Chapter 20. Accounting for Pensions and Post Retirement Benefits

Chapter 21. Accounting for Leases

Chapter 22. Accounting Changes and Error Analysis

Chapter 23. Statement of Cash Flows

Chapter 24. Presentation and Disclosure in Financial Reporting

Appendix A: Specimen Financial Statements: Marks and SpencerGroup plc

Appendix B: Specimen Financial Statements: Adidas AG

Appendix C: Specimen Financial Statements: Puma Group