Intermediate Accounting, 13th Canadian Edition

By Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, and Bruce J. McConomy

Intermediate Accounting, 13th Canadian Edition has always been, and continues to be, the gold standard that helps connect students to the what, the why, and the how of accounting information. Through new edition updates, you will be able to spark efficient and effective learning and inspire and prepare students to be the accounting professionals of tomorrow.

As students make the jump from introductory accounting to majors, some struggle with recalling earlier course concepts. WileyPLUS for Intermediate Accounting introduces an Adaptive Chapter 0: Accounting Cycle Review, helping students better grasp foundational content needed so you can move into core course topics. Students also work through WileyPLUS Adaptive Assignments, interactive tools that present bite-sized learning, and video-based instruction with 24/7, just-in-time homework help to ensure understand more complex course material. WileyPLUS also includes various Excel and data analytics applications that help students develop an accounting decision-making mindset and improve professional judgment and critical thinking – all important skill needed to be successful in the evolving accounting world.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Learn Accounting Concepts Efficiently

NEW! Adaptive Assignments ignite students’ confidence to persist so they can develop critical skills. By continuously adapting to each students’ needs and providing achievable goals with just-in-time instruction, Adaptive Assignments close knowledge gaps through scaffolded learning. Powered and refined by the Knewton Adaptive Engine, with more than 15 million users, this new assignment type gives instructors the flexibility and control to create targeted adaptive experiences that match their teaching preferences. With actionable analytics to support student and class intervention, Adaptive Assignments makes teaching and learning more efficient than ever.

Set Students Up for Intermediate Accounting Success on Day One

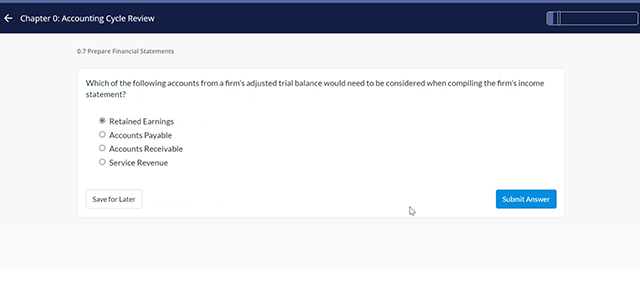

NEW! Adaptive Chapter 0: Accounting Cycle Review helps identify what knowledge gaps students have once they’ve transitioned from introductory accounting to majors through an adaptive practice experience with just-in-time instruction and remediation. With personalized instructional material, assessment, and targeted feedback, students can more successfully recall and retain foundational material in order to succeed and apply knowledge to the intermediate accounting course.

Develop Problem Solving Skills

Author-created Solution Walkthrough Lightboard Videos guide students through multi-learning objective problems to help consolidate understanding and provide 24/7 homework assistance for more than 50 end-of-chapter problems. These videos break down the process of completing complex questions to build students’ problem-solving skills and confidence and help students gain a deeper understanding of various technical and conceptual issues.

Hundreds of algorithmic questions, available across all levels of Blooms taxonomy, help student learn accounting and develop problem solving skills.

Develop Data Analytics and Literacy Skills

NEW! DAIS filter has been added in the assignment builder in WileyPLUS to make it easier for instructors to filter and assign questions based on the Data Analytics Information Systems knowledge criteria specified in the 2020 CPA Competency Map.

Power BI and Tableau Visualization Assignments in WileyPLUS familiarize students with popular data analysis tools they will encounter in the workplace. Students analyze a variety of visualizations available in both software programs, completing assessment questions along the way to check their understanding and ability to interpret different forms of information, and practice making informed business decisions.

NEW! Analytics in Action Features and Videos use Power BI-based data visualizations and dashboards to tell the stories of various business scenarios. Over 20 author-created videos drill deeper into the visualizations and dashboards, helping further explain how data visualizations can be used to tell the story behind the numbers.

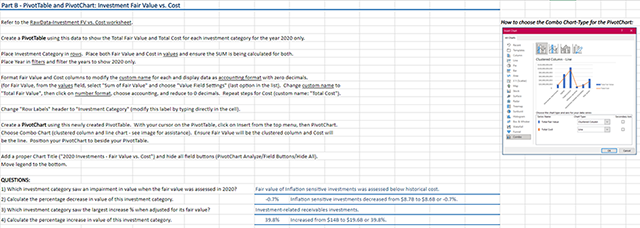

Additional Data Analytics Problems in the end-of-chapter material provide students with opportunities to analyze information and prepare simple visualizations using Excel. These problems range in difficulty and offer varied data sets, providing instructors with the flexibility to assign problems that are at the appropriate level for their students. Data sets and detailed instructions accompany these questions in WileyPLUS.

Solve Business Problems with Excel

NEW! Solution Walkthrough Videos with Excel walk students through how to use basic and advanced Excel functions to solve select accounting problems from the text.

NEW! Gradable Excel Assignments develop the Excel knowledge and skills students need by giving them the opportunity to practice using formulas and functions to complete specific exercises in a real Microsoft Excel worksheet. With exercises based on accounting questions from the book, automatic grading, and immediate and detailed cell-level feedback, students build key skills needed to be competitive in today’s job market while enhancing their understanding of key accounting concepts.

Instructors Get Started Quickly with Pre-Built Courses

NEW! WileyPLUS Course Collection allows instructors to create their WileyPLUS courses confidently and easily by leveraging a library of gold-standard pre-built courses. Based on learning science, pre-built courses reflect insights from authors and subject matter experts to provide inspiration for engaging, effective course design and are fully customizable, giving you the flexibility to create your version of the perfect course.

What’s New to This Course

- New WileyPLUS Adaptive Assignments effectively close knowledge gaps through a personalized adaptive experience that provides just-in-time instruction, immediate feedback, and remediation to previous learning objectives. With 3 assignment types to choose from (Pre-Lecture, Practice, Review), instructors can leverage Adaptive Assignments in various ways to build their students’ confidence and mastery of course concepts.

- New Adaptive Chapter 0: Accounting Cycle Review identifies what knowledge gaps students have through an adaptive practice experience with just-in-time instruction and remediation. With personalized practice, students can recall and retain foundational material, helping them succeed and apply knowledge to the intermediate accounting course.

- New Gradable Excel assignments available in WileyPLUS helps develop the Excel knowledge and skills students need to successfully compete in today’s job market, while enhancing their understanding of key accounting concepts.

- New Solution Walkthrough Videos with Excel walk students through how to use basic and advanced Excel functions to solve select accounting problems from the text.

- New DAIS filter has been added in the assignment builder in WileyPLUS to make it easier for instructors to filter and assign questions based on the Data Analytics Information Systems knowledge criteria specified in the 2020 CPA Competency Map.

- New Analytics in Action Features and Videos use Power BI-based data visualizations and dashboards to tell the stories of various business scenarios and include over 20 author-created videos that drill deeper into the visualizations and dashboards. numbers.

- Additional Data Analytics Problems in the end-of-chapter material provide students with opportunities to analyze information and prepare simple visualizations using Excel.

- New CPA Competency Map Integration has been added which includes a mapping of the content in each chapter against the 2020 CPA Competency Map and Knowledge Supplement. This appears in Appendix D in WileyPLUS.

- New Put into Practice (PiP) Algorithmic Exercises reinforce the basics as well as cover nuances and explain reasoning. Each PiP exercise includes a fact set, instructions, and a solution and are included as algorithmic practice problems within the online course, allowing students to practice these scenario-based questions until they are mastered.

- New WileyPLUS Course Collection allows instructors leverage a library of gold-standard pre-built courses that are designed based on learning science. Pre-built courses reflect insights from authors and subject matter experts to provide inspiration for engaging, effective course design and are fully customizable.

Content Changes:

- New emphasis on sustainability has been included throughout the course, including relevant cases and research assignments. Sustainability is growing in importance as accountants are increasingly being called on to collect data and prepare reports on sustainability, as well as providing assurance on such information, which is becoming more important to an increasing number of stakeholders.

- New emphasis on readability focuses on using fewer abbreviations, clearer language, shorter sentences, numbered lists, and clearer headings.

- Re-structured Put into Practice exercises in each chapter make them more accessible for students.

- Updates to the material have been made to ensure content is current and accurate. Where has been a significant change in an accounting standard or how it is applied, it has been highlighted with a significant change wordmark.

Donald E. Kieso, Ph.D., CPA, received his bachelor’s degree from Aurora University and his doctorate in accounting from the University of Illinois. He has served as chairman of the Department of Accountancy and is currently the KPMG Emeritus Professor of Accountancy at Northern Illinois University. He has public accounting experience with Price Waterhouse & Co. (San Francisco and Chicago) and Arthur Andersen & Co. (Chicago) and research experience with the Research Division of the American Institute of Certified Public Accountants (New York). He has done post doctorate work as a Visiting Scholar at the University of California at Berkeley and is a recipient of NIU’s Teaching Excellence Award and four Golden Apple Teaching Awards. Professor Kieso is the author of other accounting and business books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Illinois CPA Society. He has served as a member of the Board of Directors of the Illinois CPA Society, the AACSB’s Accounting Accreditation Committees, the State of Illinois Comptroller’s Commission, and he has served as Secretary-Treasurer of the Federation of Schools of Accountancy and as Secretary-Treasurer of the American Accounting Association. Professor Kieso is currently serving on the Board of Trustees and Executive Committee of Aurora University, as a member of the Board of Directors of Kishwaukee Community Hospital, and as Treasurer and Director of Valley West Community Hospital. From 1989 to 1993, he served as a charter member of the national Accounting Education Change Commission. He is the recipient of the Outstanding Accounting Educator Award from the Illinois CPA Society, the FSA’s Joseph A. Silvoso Award of Merit, the NIU Foundation’s Humanitarian Award for Service to Higher Education, a Distinguished Service Award from the Illinois CPA Society, and in 2003, an honorary doctorate from Aurora University.

Jerry J. Weygandt, PhD, CPA, is Arthur Andersen Alumni Emeritus Professor of Accounting at the University of Wisconsin-Madison. He holds a PhD in accounting from the University of Illinois. Articles by Professor Weygandt have appeared in the Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Professor Weygandt is author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of the Accounting Review; he also has served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC). He has served on the FASB task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Professor Weygandt has received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

Terry D. Warfield, PhD, CPA, is the PwC Professor in Accounting at the University of Wisconsin-Madison. He received a B.S. and M.B.A. from Indiana University and a Ph.D. in accounting from the University of Iowa. Professor Warfield’s area of expertise is financial reporting, and prior to his academic career, he worked for five years in the banking industry. He served as the Academic Accounting Fellow in the Office of the Chief Accountant at the U.S. Securities and Exchange Commission in Washington, D.C., from 1995–1996. Professor Warfield’s primary research interests concern financial accounting standards and disclosure policies. He has published scholarly articles in The Accounting Review, Journal of Accounting and Economics, Research in Accounting Regulation, and Accounting Horizons, and he has served on the editorial boards of The Accounting Review, Accounting Horizons, and Issues in Accounting Education. He has served as president of the Financial Accounting and Reporting Section, the Financial Accounting Standards Committee of the American Accounting Association (Chair 1995–1996), and on the AAAFASB Research Conference Committee. He also served on the Financial Accounting Standards Advisory Council of the Financial Accounting Standards Board, and he currently serves as a trustee of the Financial Accounting Foundation. Professor Warfield has received teaching awards at both the University of Iowa and the University of Wisconsin, and he was named to the Teaching Academy at the University of Wisconsin in 1995. Professor Warfield has developed and published several case studies based on his research for use in accounting classes. These cases have been selected for the AICPA Professor-Practitioner Case Development Program and have been published in Issues in Accounting Education. He served on the Board of the Illinois CPA Society, then AACSB’s Accounting Accreditation Committees, the State of Illinois Comptroller’s Commission, as secretary-treasurer of the Federation of Schools of Accountancy, and as secretary-treasurer of the American Accounting Association.

Irene M. Wiecek, FCPA, FCA, is a Professor of Accounting, Teaching Stream, at the University of Toronto, where she is cross-appointed to the Institute for Management & Innovation and the Joseph L. Rotman School of Management. She has taught financial reporting in various programs, including the Commerce Program (Accounting Specialist) and the CPA-accredited Master of Management & Professional Accounting Program (MMPA). The Director of the MMPA Program, she co-founded (in 2004) and was Director of the CPA/Rotman Centre for Innovation in Accounting Education, which supported and facilitated innovation in accounting education until 2018. Irene founded and currently directs the BIGDataAIHUB, an interdisciplinary space for faculty, students, and stakeholders to discuss and learn about issues related to big data and artificial intelligence. She has been involved in professional accounting education for many years, sitting on various provincial and national professional accounting organization committees. In the area of standard setting, she was a member of the IFRS Discussion Group (IDG) until 2020. Irene has authored and co-authored numerous publications and is on the editorial board of Accounting Perspectives. In 2019 she was appointed to the CPA Competency Map Task Force (which is taking a blank slate approach to creating a fresh CPA Competency Map, laying out the skills and competencies required of the future-focused CPA). She is a member of CPA Canada’s Data Governance Committee, which examines the prominent role that CPAs will continue to play in a data-rich environment.

Bruce J. McConomy, PH.D., CPA, CA, is a Professor of Accounting and a KPMG Foundation Fellow in Accounting at the Lazaridis School of Business and Economics at Wilfrid Laurier University in Waterloo, Ontario. He was a Senior Audit Manager with Deloitte before returning to Queen’s University to obtain his Ph.D. in accounting. Bruce is Director of the Graduate Diploma in Accounting program at Laurier and was Director of the CPA Ontario Centre for Capital Markets and Behavioural Decision Making, and its predecessor Centre, from 2005 to 2018. He has been teaching intermediate financial accounting since 2000 in Laurier’s B.B.A. and M.B.A. programs, and also teaches in Laurier’s Ph.D. in Management program. Bruce has published articles in Contemporary Accounting Research; Journal of Accounting, Auditing and Finance; Journal of Business, Finance and Accounting; Accounting, Auditing & Accountability Journal; Canadian Journal of Administrative Sciences; Critical Perspectives on Accounting; Accounting History; and Accounting Perspectives. He has also published cases in Issues in Accounting Education, Canadian Financial Accounting Cases—3rd edition, Accounting Perspectives, and Journal of Accounting Case Research. Bruce is a member of the Academic Advisory Committee of the Accounting Standards Board. He is also an Associate Editor and is on the Advisory Committee of Accounting Perspectives and is on the Editorial Advisory Board of the International Journal of Accounting & Information Management.

Volume 1

- The Canadian Financial Reporting Environment

- Conceptual Framework Underlying Financial Reporting

- Data, Decisions, and Measurement

- Reporting Financial Performance

- Financial Position and Cash Flows

- Revenue Recognition

- Cash and Receivables

- Inventory

- Investments

- Property, Plant, and Equipment: Accounting Model Basics

- Depreciation, Impairment, and Disposition

- Intangible Assets and Goodwill

Volume 2

- Non-Financial and Current Liabilities

- Long-Term Financial Liabilities

- Shareholders’ Equity

- Complex Financial Instruments

- Earnings per Share

- Income Taxes

- Pensions and Other Post-Employment Benefits

- Leases

- Accounting Changes and Error Analysis

- Statement of Cash Flows

- Other Measurement and Disclosure Issues

Appendix A: Time Value of Money Tables

Appendix B: A Summary of the Case Primer

Appendix C: The Accounting Information System*

Appendix D: Specimen Financial Statements*

Appendix E: CPA Competency Map Coverage*

*Online only