Personal Finance, 2nd Edition

By Vickie Bajtelsmit

Personal Finance, 2nd Edition offers essential skills and knowledge that will set students on the road to lifelong financial wellness. By focusing on real-world decision making, Bajtlesmit engages a diverse student population by helping them make personal connections that can immediately impact their current financial situations. Using a conversational writing style, relatable examples and up-to-date coverage on important topics like student debt, students gain the knowledge they need to avoid early financial mistakes. By the end of the course, students have identified their goals and developed the problem-solving skills they need to build on as they progress to the next stages of life.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Demonstration problems with video content provide just-in-time homework help.

Within each chapter, demonstration problems provide step-by-step directions for sample problems. These serve as an easy reference for students to consult when working on homework problems involving financial math. In addition, demonstration problem videos using lightboard technology help students better understand the process of working through these problems.

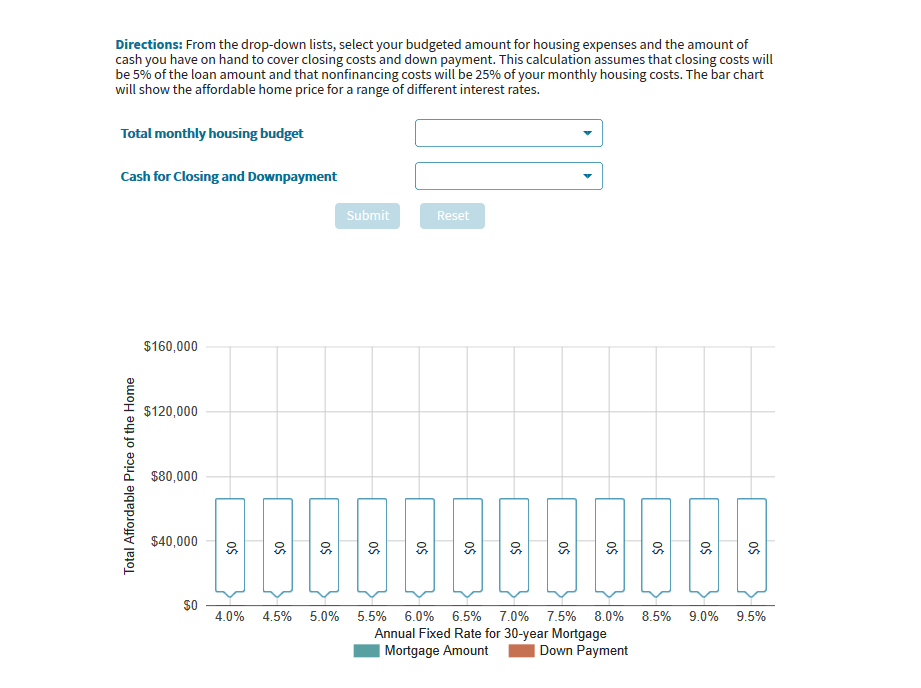

Interactives improve critical thinking.

Integrated throughout the WileyPLUS modules, interactives reinforce core concepts and help students see the relevance of the content to their own lives, providing opportunities for learning and critical thinking.

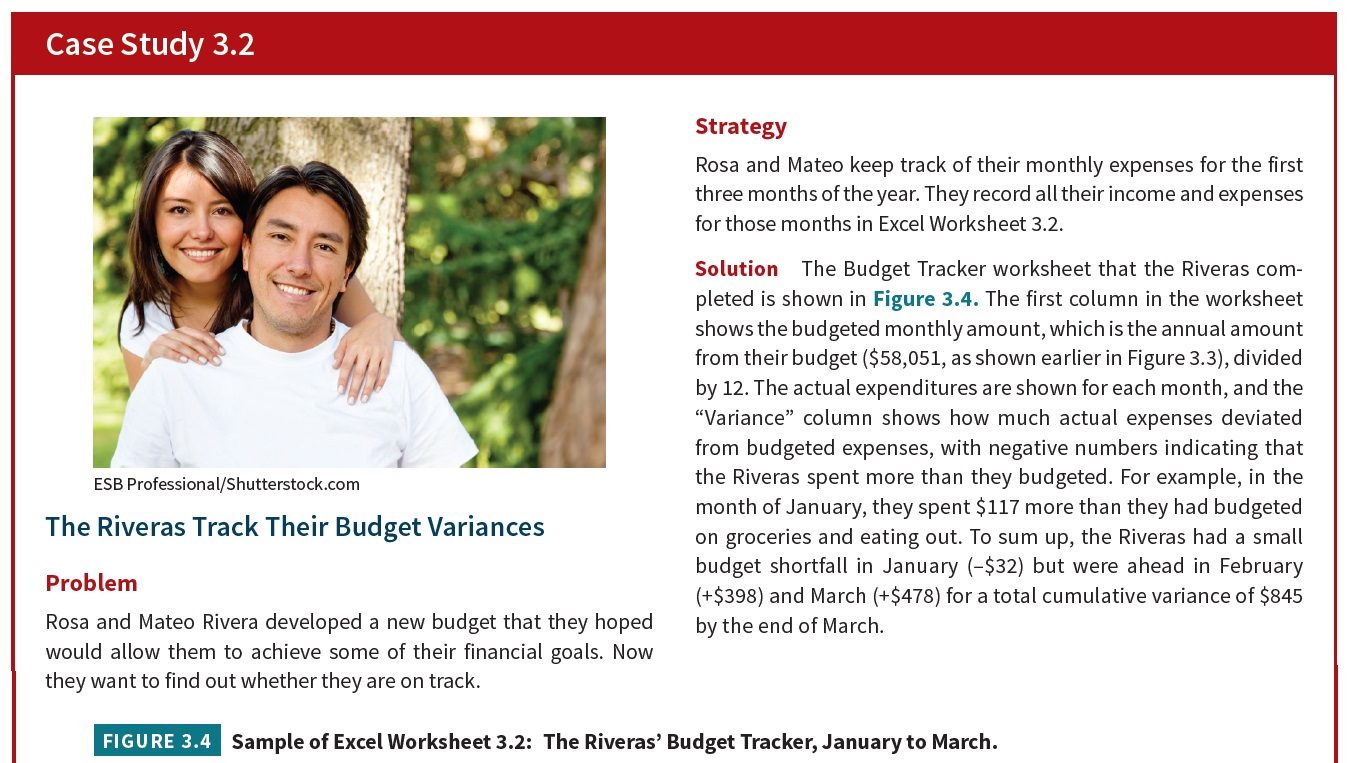

Case Studies help students engage with the material.

Each chapter includes one or more realistic mini-cases about a personal finance decision for an individual or family, with a detailed solution and discussion. These allow students to practice applying their new conceptual and analytical knowledge to real-world problems.

- Interactives: Innovative interactives help students develop a better understanding of chapter concepts in a fun way. There are several types of activities in each chapter, including personal self-assessments, concept applications, and interactive visual tools.

- Peer-to-Peer Videos: Videos featuring actual students and professionals illustrate the impact of financial decisions and act as a catalyst for deeper discussion.

- Online Calculator Video Demonstrations: Taking advantage of the multitude of online resources that are available today, the new edition includes a video in each chapter that highlights particularly useful online calculators and walks students through how to use them to make financial decisions relevant to the chapter content.

- Adaptive Practice: WileyPLUS provides students with a personal, adaptive learning experience, allowing them to identify what they know and don’t know early, build their proficiency on topics, and use their study time most effectively. Faculty can use the performance reports to better identify student knowledge gaps. Classroom tests show that students who use the Adaptive Practice questions tend to have better course performance than those who do not.

- Excel Worksheets: The course includes many downloadable Excel Personal Financial Planning worksheets. Many of these are designed to be used by students to develop their own personal financial plan. Instructors who do not require students to use a financial calculator will appreciate the Excel worksheets that have been designed to simplify financial math calculations for students.

- Case Study Applications: Applying personal finance concepts to real-life problems makes the material more “real” for students. Each section includes one or more case examples in which a family or individual faces a personal finance problem such as budgeting, credit management, or saving for a child’s education. The case solutions identify how to use recently presented text content to solve the problem. Although these short cases generally relate to a single learning objective, the assignable cases in the end-of-chapter section are more comprehensive.

Features Include:

Vickie Bajtelsmit is a Professor in the Department of Finance and Real Estate at Colorado State University, where she has taught a wide variety of undergraduate and graduate classes, including personal finance, financial planning, risk management and insurance, real estate, employee benefits, and investments. She has been the Director of the Master of Finance Program since 2011 and was the Department Chair from 2007 to 2012. She earned her Ph.D. from the University of Pennsylvania’s Wharton School of Business and holds a J.D. from Rutgers University School of Law. In addition to her previous personal finance books, A Busy Woman’s Guide to Financial Freedom (2001), Personal Finance: Skills for Life (2006), Personal Finance: Managing Your Money and Building Wealth (2008), and the first edition of Personal Finance (2016), she has authored numerous articles in academic and professional journals, focused on personal finance issues related to retirement, insurance, investments, and real estate. Previous professional accomplishments include service as the President of the American Risk and Insurance Association (2010), President of the Risk Theory Society (2010), and President of the Academy of Financial Services (2004) and service on the CFP-Board committee that developed the model curriculum for financial planning programs. She currently serves on the national Board of Trustees for the Jump$tart Coalition for Personal Financial Literacy and the Board of Directors for Junior Achievement of Northern Colorado, is an Associate Editor for several academic journals, and participates actively in several Society of Actuaries research groups.

- The Financial Planning Process

- Financial Planning Tools: Personal Financial Statements and the Time Value of Money

- Budgeting and Cash Management

- Tax Planning

- Managing Consumer Credit: Credit Cards and Consumer Loans

- Making Automobile and Housing Decisions

- Insuring Cars and Homes

- Life Insurance and Long-Term Care Planning

- Employee Benefits: Health, Disability, and Retirement Plans

- Savings for Distant Goals: Retirement and Education Funding

- The Fundamentals of Investing

- Investing in Stocks and Bonds

- Investing in Mutual Funds and Real Estate

- Estate Planning