Fundamentals of Corporate Finance, 4th Edition

By Robert Parrino, Thomas Bates, Stuart L. Gillan, and David S. Kidwell

Fundamentals of Corporate Finance, 4th Edition develops the key concepts of corporate finance with an intuitive approach while emphasizing computational skills, enabling students to develop the critical judgments necessary to apply financial tools in real-world decision-making situations. This course offers a level of rigor that is appropriate for both business and finance majors and includes adaptive practice tools, problem-solving support, and homework and video resources.

The next generation of WileyPLUS for Fundamentals of Corporate Finance gives instructors the freedom and flexibility to tailor content and easily manage their course to keep students engaged and on track.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

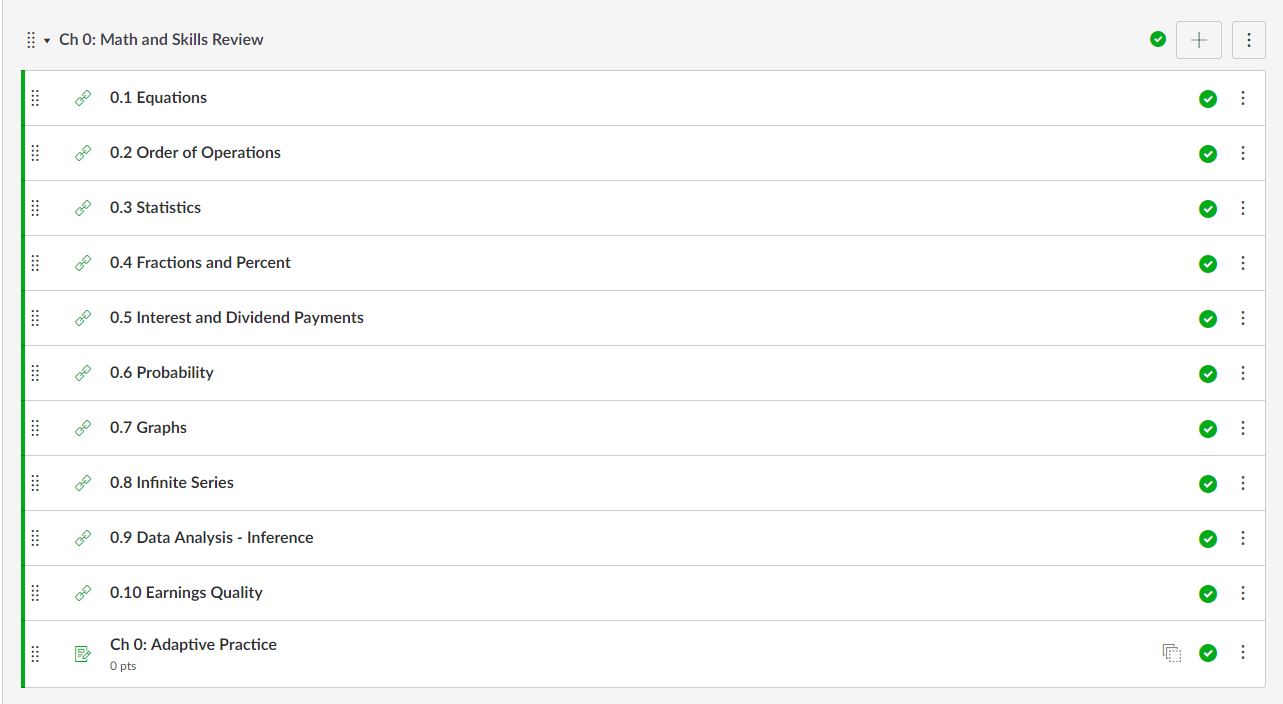

Math and skills review ensures students are prepared to succeed.

Students get plenty of adaptive review and practice with essential math topics they need to master corporate finance. Built to serve as a refresher of remedial content, reading content, algorithmic practice, and Figuring Finance Interactive Tutorials are designed to improve student retention and help them connect difficult math and finance concepts.

Solution walkthrough videos give students 24/7 just-in-time homework assistance.

Solution Walkthrough Lightboard Videos are included in each course section and provide step-by-step walkthrough solutions to question and problems similar in look and feel to the course homework.

Students see how Excel functions apply to corporate finance.

Students benefit from step-by-step examples of how to use specific Excel functions. Excel templates are available for all applicable end-of-chapter problems to support Excel function examples.

Features Include:

- An Intuitive Approach: Explaining finance concepts in an intuitive manner helps students develop a richer understanding of those concepts and gain insight into how finance problems can be approached. “Building Intuition” boxes present important finance concepts along with examples or explanations to help the student understand the concept and develop financial intuition.

- Financial Decision-Making: Emphasizing the role of the financial manager, these examples provide students with experience in financial decision making. Students are presented with a scenario and asked to make decisions based on the information presented.

- Finance Weekly Updates (www.wileyfinanceupdates.com): Weekly online updates bring you the latest news relevant to your finance course.

- NEW Tax Update Appendix: This resource addresses the changes to the 2017 Tax Cuts and Jobs Act (TCJA) and provides instructors with a clear way to incorporate new tax code updates including end-of-chapter questions and auto-graded homework.

- Narrated PowerPoints™: The PowerPoints are available for every learning objective and provide students with an enhanced mobile-friendly experience that allows them to navigate by sub-topic to review the content they find most challenging.

- Concepts in Action Videos: These videos feature scenarios involving real-world companies to reinforce financial concepts, with assignable questions available per video.

- Learn by Doing Interactive Tutorials: Quantitative problems with step-by-step solutions help students better understand how to apply their intuition and analytical skills to solve problems.

ROBERT PARRINO is a member of the faculty at the University of Texas since 1992. He teaches courses in regular degree and executive education programs as well as in customized executive education courses for industrial, financial, and professional firms. He has also taught at the University of Chicago, University of Rochester, and IMADEC University in Vienna. Parrino has received numerous awards for teaching excellence at the University of Texas from students, faculty, and the Texas Exes (alumni association). Parrino has been involved in advancing financial education outside of the classroom in a variety of ways. As a Chartered Financial Analyst (CFA) charter holder, he has been very active with the CFA Institute as a member of the candidate curriculum committee and as a regular speaker at the annual Financial Analysts Seminar. He has spoken at over 20 Financial Analyst Society meetings, and he served as a member of the planning committee for the CFA Institute’s Annual Meeting. Parrino is also the founding director of the Hicks, Muse, Tate & Furst Center for Private Equity Finance at the University of Texas. The center sponsors conferences and other educational activities in areas related to private equity finance. Parrino was vice president for financial education of the Financial Management Association (FMA) from 2008 to 2010 and an academic director of the FMA from 2011 to 2013. In 2017, he was elected to be VP-Program for the 2019 FMA annual meeting. He also co-founded the Financial Research Association and is associate editor of the Journal of Corporate Finance.

Parrino’s research focus includes corporate governance, financial policies, restructuring, mergers and acquisitions, and private equity markets. He has published his research in several journals, including the Journal of Finance, Journal of Financial Economics, Journal of Financial and Quantitative Analysis, Journal of Law and Economics, Journal of Portfolio Management, and Financial Management. Parrino has won numerous awards for his research, including the 2013–2014 Career Award for Outstanding Research Contributions at the McCombs School of Business.

Parrino has experience in the application of corporate finance concepts in a variety of business situations. Since entering the academic profession, he has been retained as an advisor on valuation issues concerning businesses with enterprise values ranging to more than $1 billion and has consulted in areas such as corporate financing, compensation, and corporate governance. Parrino was previously president of Sprigg Lane Financial, Inc., a financial consulting firm with offices in Charlottesville, Virginia, and New York City. While at Sprigg Lane, he was on the executive, banking, and portfolio committees of the holding company that owns Sprigg Lane. Before joining Sprigg Lane, Parrino was on the Corporate Business Planning and Development staff at Marriott Corporation. At Marriott, he conducted fundamental business analyses and preliminary financial valuations of new business development opportunities and potential acquisitions. Parrino holds a B.S. in chemical engineering from Lehigh University, an MBA degree from The College of William and Mary, and M.S. and Ph.D. degrees in applied economics and finance, respectively, from the University of Rochester.

STUART L. GILLAN is associate professor of finance in the Terry College of Business at the University of Georgia. His industry experience includes time as associate chief economist at the United States Securities and Exchange Commission (SEC) and senior research fellow with TIAA, a New York-based financial services company.

Before joining the University of Georgia, he held academic positions at Arizona State University, the University of Delaware, the University of Hong Kong, the University of Otago, and Texas Tech University. He has also been a visiting scholar at the Chinese University of Hong Kong, the University of Canterbury, and the Hong Kong Polytechnic University, and he was a William Evans Fellow at the University of Otago. In addition to teaching corporate finance classes to undergraduate, masters, MBA and executive MBA students, Gillan has taught in several customized executive education and corporate programs. In recognition of his teaching, he received a Terry College of Business Hugh O. Nourse Outstanding MBA Teacher Award.

Additionally, Gillan has served as co-editor of the Journal of Corporate Finance, associate editor of the Review of Financial Studies, and associate editor of Accounting and Finance, and he serves on the editorial advisory board of the Journal of Applied Corporate Finance. He has written and published extensively on corporate finance and corporate governance, including topics such as corporate restructuring, executive compensation, shareholder activism, shareholder voting, and the structure and activity of corporate boards. His research has been published in the Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of Corporate Finance, Journal of Risk and Insurance, Financial Management, and the Journal of Applied Corporate Finance, among others. He has also received best paper awards from academic finance groups, including the Financial Management Association International, the Indian School of Business Center for Analytical Finance, and the Western Finance Association.

Gillan received his Ph.D. from the Graduate School of Business at the University of Texas, Austin. His bachelor of commerce (Honors) and masters of commerce degrees are from the University of Otago, New Zealand.

THOMAS W. BATES is the chair of the Department of Finance and Dean’s Council of 100 Distinguished Scholars at the W. P. Carey School of Business, Arizona State University. He has also taught courses in finance at the University of Delaware, the Ivey School of Business at the University of Western Ontario, and the University of Arizona where he received the Scrivner teaching award. During his career as an educator, Bates has taught corporate finance to students in undergraduate, MBA, executive MBA, and Ph.D. programs, as well as in custom corporate educational courses.

Bates is a regular contributor to academic finance literature in such journals as the Journal of Finance, Journal of Financial Economics, Journal of Financial and Quantitative Analysis, and Financial Management. His research addresses a variety of issues in corporate finance, including the contracting environment in mergers and acquisitions, corporate liquidity decisions and cash holdings, and the governance of corporations. In practice, Bates has worked with companies and legal firms as an advisor on issues related to the valuation of companies and corporate governance. Bates received a B.A. in economics from Guilford College and his doctorate in finance from the University of Pittsburgh.

DAVID S. KIDWELL has over 30 years of experience in financial education as a teacher, researcher, and administrator. He has served as dean of the Carlson School at the University of Minnesota and of the School of Business Administration at the University of Connecticut. He was also on the faculty at the Krannert Graduate School of Management, Purdue University, where he was twice voted the outstanding undergraduate teacher of the year. An expert on the U.S. financial system, Kidwell is the author of more than 80 articles dealing with the U.S. financial system and capital markets.

Kidwell has published his research in the leading journals, including the Journal of Finance, Journal of Financial Economics, Journal of Financial and Quantitative Analysis, Financial Management, and Journal of Money, Credit, and Banking. Kidwell holds an undergraduate degree in mechanical engineering from California State University at San Diego, an MBA with a concentration in finance from California State University at San Francisco, and a Ph.D. in finance from the University of Oregon.

1. The Financial Manager and the Firm

2. The Financial System and the Level of Interest Rates

3. Financial Statements, Cash Flows, and Taxes

4. Analyzing Financial Statements

5. The Time Value of Money

6. Discounted Cash Flows and Valuation

7. Risk and Return

8. Bond Valuation and the Structure of Interest Rates

9. Stock Valuation

10. The Fundamentals of Capital Budgeting

11. Cash Flows and Capital Budgeting

12. Evaluating Project Economics

13. The Cost of Capital

14. Working Capital Management

15. How Firms Raise Capital

16. Capital Structure Policy

17. Dividends, Stock Repurchases and Payout Policy

18. Business Formation, Growth, and Valuation

19. Financial Planning and Managing Growth

20. Options and Corporate Finance

21. International Financial Management