College Accounting

By Jerry Weygandt, Paul Kimmel, DeAnna Martin, and Jill Mitchell

College Accounting provides the beginning accounting student with the fundamentals of financial accounting through clear, concise, and easy-to-read text with examples and practice opportunities along the way. Combining the expertise of successful authors Paul Kimmel and Jerry Weygandt and the perspectives of two community colleges professors, DeAnna Martin and Jill Mitchell, this resource is the perfect blend of solid, time-tested content and a new streamlined design of embedded charts, lists, illustrations, and videos that help students grasp difficult concepts.

College Accounting is available with WileyPLUS Next Gen, which gives you the freedom and flexibility to tailor content and easily manage your course to keep students engaged and on track.

Want to learn more about WileyPLUS? Click Here

Animations make learning fun and engaging.

These short animated videos engage students and simplify major concepts in the book, making the concepts easier to understand. They offer an alternative approach to understanding the written material.

Videos reinforce concepts and help sharpen problem-solving skills.

Solution Walkthrough Videos are available as question assistance and help students learn problem-solving techniques. These videos walk students through solutions step by step and are based on the most regularly assigned exercises and problems in the text.

Mobile-friendly, interactive tutorials are ideal for students on the go.

Interactive Tutorials are available in an enhanced mobile-friendly learning environment, giving students the opportunity to study anytime, anywhere. You can assign these as pre-lecture assignments to ensure that students come to class prepared.

Real-world company videos provide timely, relevant information.

Real-world company videos feature both small businesses and larger companies to help students apply content and see how business owners apply concepts from the textbook to the real world.

Features Include

- College Accounting incorporates an innovative micro-learning design where bulleted lists, charts, illustrations, videos, and graphs help to break up the text. Students are presented with shorter topics, less pedagogical elements, and consistent step-by-step instruction.

- Financial Literacy Videos address how basic accounting and finance-related issues are addressed in day-to-day life.

- Customization of your course comes with WileyPLUS. Do you have your own questions you want programed? Do you want content removed or created especially for your course and your school? Maybe there is a paper practice set you’ve been using and want to make it an algorithmic, auto-graded experience in your WileyPLUS course. Wiley now offers course and instructional design services for our WileyPLUS users.

Jerry J. Weygandt, PhD, CPA, is Arthur Andersen Alumni Emeritus Professor of Accounting at the University of Wisconsin-Madison. He holds a PhD in accounting from the University of Illinois. Articles by Weygandt have appeared in the Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Weygandt is the author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of the Accounting Review. Weygandt also served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC). He has served on the Financial Accounting Standards Board task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Weygandt has received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

Paul D. Kimmel, PhD, CPA, received his bachelor’s degree from the University of Minnesota and his doctorate in accounting from the University of Wisconsin. He is an Associate Professor at the University of Wisconsin-Milwaukee (UWM) and has public accounting experience with Deloitte & Touche (Minneapolis). He was the recipient of the UWM School of Business Advisory Council Teaching Award, the Reggie Taite Excellence in Teaching Award, and a three-time winner of the Outstanding Teaching Assistant Award at the University of Wisconsin. He is also a recipient of the Elijah Watts Sells Award for Honorary Distinction for his results on the CPA exam. He is a member of the American Accounting Association and the Institute of Management Accountants and has published articles in Accounting Review, Accounting Horizons, Advances in Management Accounting, Managerial Finance, Issues in Accounting Education, Journal of Accounting Education, and in other journals. His research interests include accounting for financial instruments and innovation in accounting education. He has published papers and given numerous talks on incorporating critical thinking into accounting education and helped prepare a catalog of critical thinking resources for the Federated Schools of Accountancy.

DeAnna Martin, MBA, CPA, is a full time, tenured professor at Santiago Canyon College in Orange, California. She has been teaching since 2001, both in the classroom and online. DeAnna teaches financial accounting, managerial accounting, and small business accounting. On occasion, she teaches QuickBooks®, cost accounting, or auditing. Before teaching, she worked at several CPA firms, starting at Deloitte in Orange County, California. She worked in both the auditing and tax departments. She became the lead trainer for incoming staff, and she also designed and led training sessions for clients on using their accounting software programs. DeAnna obtained her CPA license, and she earned her MBA degree with a double emphasis in accounting and finance. She is a member of the American Accounting Association and the California Society of Certified Public Accountants. She has earned two online teaching certifications, utilizing both Blackboard and Canvas platforms. DeAnna has been actively involved in the Pathways project to reach out to high school students as they transition into college. She has also served with the Online Education Initiative to design a California state-wide online course standard for all courses submitted to the California Virtual Campus.

Jill E. Mitchell, MS, CIA, is an Associate Professor of Accounting at Northern Virginia Community College (NOVA), where she has taught principles of accounting (I and II) and auditing courses in the classroom, hybrid, and online since 2008. Since 2009, she has been an adjunct instructor at George Mason University (GMU) in Fairfax, Virginia, where she has taught financial accounting, accounting for non-business majors, and an MBA accounting course. She is the past president of the Washington, D.C. Chapter of the Accounting and Financial Women’s Alliance (AFWA), and she served on the board of directors of the Virginia Society of CPAs (VSCPA). She is a member of the American Accounting Association and the Institute of Internal Auditors. She received the Community College Champion Award for her work as a founding advisor for the National Society of Collegiate Scholars (NSCS) NOVA Chapter. Prior to joining the faculty at NOVA, Jill was a senior auditor with Ernst & Young’s Business Risk Services practice in Miami, Florida. She is a certified internal auditor and earned an MS in accountancy from the University of Virginia and a BBA in management information systems from the University of Georgia honors program. She earned a graduate certificate in E-Learning Instructional Design from GMU, and she is pursuing an M.Ed. in curriculum and instruction with a concentration in instructional design and technology. Jill is a 2019 recipient of the Outstanding Faculty Award, the Commonwealth’s highest honor for faculty of Virginia’s universities and colleges.

1. Welcome to Accounting

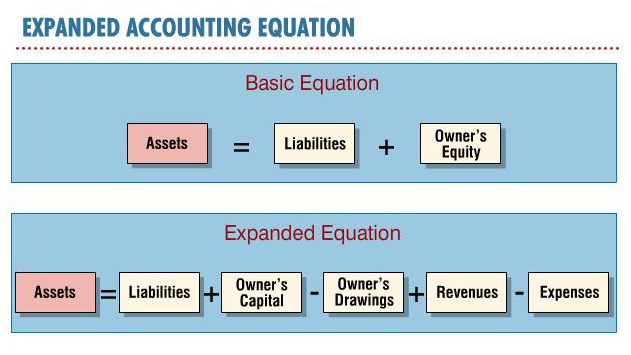

2. The Accounting Equation and Transaction Analysis

3. The Recording Process: Debits and Credits

4. The Recording Process: The Journal, The Ledger, and the Trial Balance

5. Adjusting the Accounts and Preparing an Adjusted Trial Balance

6. Completing a Worksheet and Completing the Accounting Cycle

7. Merchandising Companies: Purchases (Perpetual)

8. Merchandising Companies: Sales (Perpetual)

9. Merchandising Companies: Worksheets and Financial Statements (Perpetual)

10. Special Journals

11. Inventory

12. Cash, Banking, and Internal Controls

13. Payroll Accounting: Employee Taxes and Records

14. Payroll Accounting: Employer Taxes and Records

A. Merchandising Companies: Purchases (Periodic)

B. Merchandising Companies: Sales (Periodic)

C. Merchandising Companies: Worksheet and Financial Statements (Periodic)

Click here to find out more about the new authors, DeAnna Martin and Jill Mitchell.