Auditing: A Practical Approach, 4th Canadian Edition

By Robyn Moroney, Fiona Campbell, Jane Hamilton, and Valerie R. Warren

Auditing: A Practical Approach, 4th Canadian Edition prepares today’s students to meet the rapidly changing demands of the auditing profession with a focus on data-driven analysis and decision-making. Students work through a full audit in a practical and applied manner, developing the professional judgement and critical thinking skills needed to make real decisions auditors face every day.

Students are introduced to the language, key processes, and level of thinking required to build ethical and audit reasoning through an integrated case-based approach that better prepares them for successful completion of the CPA exam and the builds the confidence needed to succeed as a modern auditing professional.

Want to learn more about WileyPLUS? Click Here

Learn Accounting Concepts Efficiently

Adaptive Assignments ignite students’ confidence to persist so they can develop critical skills. By continuously adapting to each students’ needs and providing achievable goals with just-in-time instruction, Adaptive Assignments close knowledge gaps through scaffolded learning. Powered and refined by the Knewton Adaptive Engine, with more than 15 million users, this new assignment type gives instructors the flexibility and control to create targeted adaptive experiences that match their teaching preferences. With actionable analytics to support student and class intervention, Adaptive Assignments makes teaching and learning more efficient than ever.

Develop Data Analytics and Literacy Skills

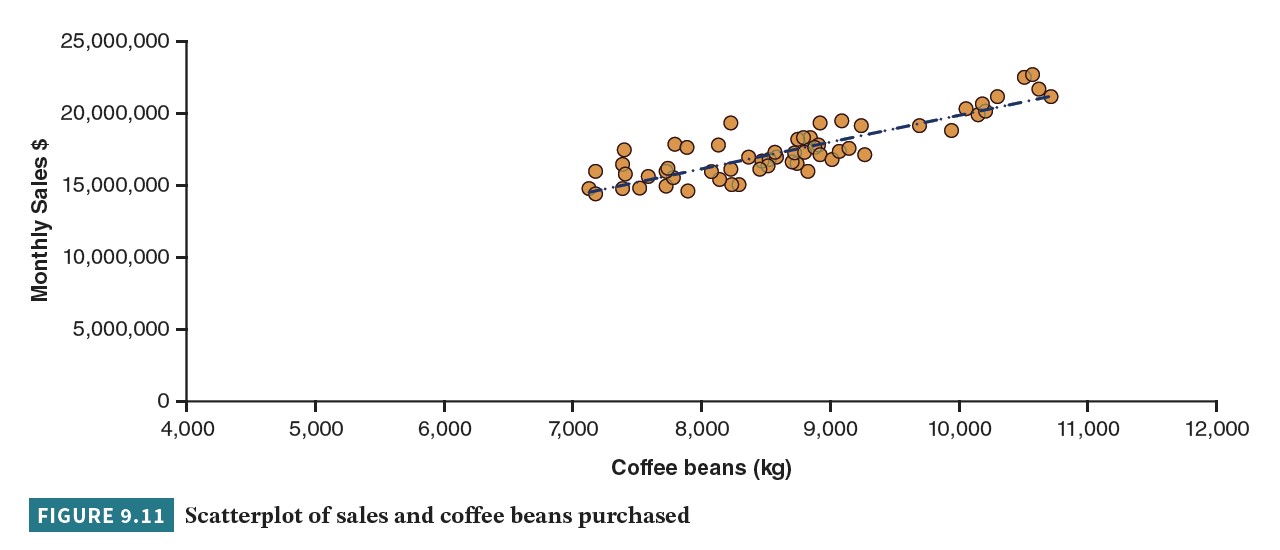

The Audit Data Analytics chapter defines audit data analytics (ADAs) and when an auditor can use them during an audit. Students work through various ADA approaches, data and documentation, and considerations to make when preparing visualizations. Feature boxes have also been added to demonstrate how ADAs are used in practice in Canada and what technologies can be used, and new end-of-chapter material tests student understanding with a mix of analytical, knowledge-based, and data manipulation questions.

Power BI and Tableau Visualization Assignments in WileyPLUS familiarize students with popular data analysis tools they will encounter in the workplace. Students analyze a variety of visualizations available in both software programs, completing assessment questions along the way to check their understanding and ability to interpret different forms of information, and practice making informed business decisions.

The WileyPLUS Data Set Library provides instructors with the flexibility to choose how they want to build and assess students’ data analytics skills. A variety of free data sets are available for you to access across all WileyPLUS Accounting courses, saving you valuable time in sourcing out data sets to use with projects, assessments, and homework.

Case-Based Learning Builds Professional Judgement and Critical Thinking Skills

Integrated throughout the text, the Cloud 9 continuing case allows students to apply auditing topics to realistic company scenarios. Working through a variety of homework problems, students easily connect course concepts to the real world and develop better understanding of the varied responsibilities of the modern auditor. In addition, the new standalone Alpine Bags Ltd. case available in WileyPLUS provides additional real-world context and reinforces the development of critical thinking skills.

Incorporate Cutting-Edge Topics

Introduce your students to ESG in the accounting context with the WileyPLUS ESG Module, designed to help students understand what ESG is, why it’s important, and how it’s changing the modern accounting and business world. Students work through each pillar of ESG through lessons on Environment, Social, Governance, and Reporting, along with relatable business scenarios with recognizable companies, access to real-world sample reports, and assignable quiz questions.

What’s New to the 4th Canadian Edition

- New Audit Data Analytics chapter helps students understand what audit data analytics (ADAs) are and when an auditor would use them throughout the audit process.

- New Tableau and Power BI visualization assignments in WileyPLUS build the skills required to analyze and interpret data visualizations, familiarizing students with popular data analysis tools they will encounter in the workplace.

- New Data Sets Library in WileyPLUS provides a gallery of data sets that map to specific accounting topics and can be used for students to learn how to conduct, analyze, and interpret visualizations in a variety of software including Excel, Tableau, Power BI, and IDEA.

- The Alpine Bags Ltd. Case Book in WileyPLUS is an independent case study separate from the Cloud 9 case in the text. Students work through a real-world scenario and are required to complete certain auditing tasks.

- Updated accounting standards meet new CPA requirements to ensure students are better prepared to successfully complete the CPA exam. Special attention has been paid to:

- CSRS 4200 Compilation Engagements.

- CAS 315 Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment.

- CAS 540 Auditing Accounting Estimates and Related Disclosures.

- Revised the appendix in Ch 14 to expand coverage of review engagements and to reflect the new assurance standards on special reports where applicable.

ROBYN MORONEY, BEc (Hons), MCom, PhD, CA, CPA, is Associate Professor in the Department of Accounting and Finance at Monash University. Before commencing her academic career, Robyn worked as an auditor at Arthur Young, now Ernst & Young. With over 25 years of academic experience, Robyn has previously held positions at The University of Melbourne, The University of Auckland, The University New South Wales, and La Trobe University. As a member of the board of the Accounting and Finance Association of Australia and New Zealand, which represents the interests of accounting and finance academics in both countries, Robyn has taken on a number of roles including co-chairing the conference technical committee and the doctoral symposium. Her areas of research are in the behavioral (auditor decision-making processes) and economics of auditing fields.

FIONA CAMPBELL, BCom, FCA, is an Assurance Partner with Ernst & Young in Melbourne. Fiona has been serving clients since 1991 and has worked on auditing clients in the manufacturing, consumer, and industrial products industries as well as not-for-profit sector organizations. She has considerable experience in providing professional services to Australian and foreign-controlled companies including large publicly listed and private companies. Fiona is also responsible for assurance methodology and technology at Ernst & Young in Australia and has been involved in designing the firm’s global audit methodology for the past 14 years, including ensuring compliance with both international and local auditing standards.

JANE HAMILTON, BBus, MAcc, PhD, is Professor of Accounting at the Bendigo campus of the Regional School of Business, La Trobe University. She previously held academic positions at the University of Technology, Sydney. Jane has twenty years of teaching experience and has published the results of her auditing research in several Australian and international journals.

VALERIE R. WARREN, CPA, CA, MBA, teaches a variety of accounting courses including Auditing, Introductory, Intermediate and Advanced Accounting, and Accounting Theory at the Kwantlen Polytechnic University in Surrey, BC. She also serves as a Practice Review Officer for the Chartered Professional Accountants of British Columbia where she conducts practice reviews of national, regional, and small CA firms to ensure compliance with current accounting and assurance standards are met.

Chapter 1: Introduction and Review of Audit Assurance

Chapter 2: Ethics, Legal Liability, and Client Acceptance

Chapter 3: Audit Planning I

Chapter 4: Audit Planning II

Chapter 5: Audit Evidence

Chapter 6: Sampling and Overview of the Risk Response Phase of the Audit

Chapter 7: Understanding and testing the Client’s System of Internal Controls

Chapter 8: Execution of the Audit-Performing Substantive Procedures

Chapter 9: Audit Data Analytics

Chapter 10: Auditing Sales and Receivables

Chapter 11: Auditing Purchases, Payables, and Payroll

Chapter 12: Auditing Inventories and PPE

Chapter 13: Auditing Cash and Investments

Chapter 14: Completing and Reporting on the Audit