Intermediate Accounting, 18th Edition

By Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

Intermediate Accounting by Donald Kieso, Jerry Weygandt, and Terry Warfield has always been, and continues to be, the gold standard bridge to the profession. The new and improved 18th Edition presents a refreshed, accessible, and modern approach with new perspectives that help connect students to the what, the why, and the how of accounting information. With Intermediate Accounting and WileyPLUS, you will be able to spark efficient and effective learning, help create the bridge to student success, and inspire and prepare students to be the accounting professionals of tomorrow.

As students make the jump from introductory accounting to majors, some struggle with recalling earlier course concepts. WileyPLUS for Intermediate Accounting introduces an Adaptive Chapter 0: Accounting Cycle Review, helping students better grasp foundational content needed so you can move into core course topics. Students also work through WileyPLUS Adaptive Assignments, interactive tools that present bite-sized learning, and video-based instruction with 24/7, just-in-time homework that ensures they understand more complex course material. WileyPLUS also includes various hands-on applications that help students develop an accounting decision-making mindset and improve the professional judgment and critical skills needed to be successful. In addition, integrated CPA exam resources within WileyPLUS include videos, assessment, and task-based simulations that help students apply what they’ve learned to real-world scenarios and prepare them for success on the big exam.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Learn Accounting Concepts Efficiently

NEW! Adaptive Assignments ignite students’ confidence to persist so they can develop critical skills. By continuously adapting to each students’ needs and providing achievable goals with just-in-time instruction, Adaptive Assignments close knowledge gaps through scaffolded learning. Powered and refined by the Knewton Adaptive Engine, with more than 15 million users, this new assignment type gives instructors the flexibility and control to create targeted adaptive experiences that match their teaching preferences. With actionable analytics to support student and class intervention, Adaptive Assignments makes teaching and learning more efficient than ever.

NEW! Interactive Tutorial Assignments provide a guided walkthrough and review of key chapter content and topics. Interactive Knowledge Check and Do It! questions in the assignment ensure student understanding and retention. The Interactive Tutorial Assignments are available as practice, customizable and assignable by instructors for points, and are also included within the Adaptive Assignments pre-lecture assignment type.

Set Students Up for Intermediate Accounting Success on Day One

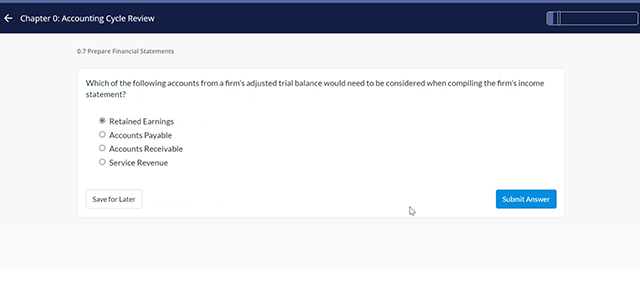

NEW! Adaptive Chapter 0: Accounting Cycle Review helps identify what knowledge gaps students have once they’ve transitioned from introductory accounting to majors through an adaptive practice experience with just-in-time instruction and remediation. With personalized instructional material, assessment, and targeted feedback, students can more successfully recall and retain foundational material in order to succeed and apply knowledge to the intermediate accounting course.

Develop Problem Solving Skills

Solution Walkthrough Videos guide students through multi-learning objective problems to help consolidate understanding and provide 24/7 homework assistance for hundreds of exercises, homework questions, and Put It Into Practice problems. These videos break down the process of completing complex questions to build students’ problem-solving skills and confidence.

Hundreds of algorithmic questions, available across all levels of Blooms taxonomy, help student learn accounting and develop problem solving skills.

Solve Business Problems with Excel

Gradable Excel Assignments develop the Excel knowledge and skills students need by giving them the opportunity to practice using formulas and functions to complete specific exercises in a real Microsoft Excel worksheet. With exercises based on accounting questions from the book, automatic grading, and immediate and detailed cell-level feedback, students build key skills needed to be competitive in today’s job market while enhancing their understanding of key accounting concepts.

Develop Data Analytics and Literacy Skills

Power BI and Tableau Visualization Assignments in WileyPLUS familiarize students with popular data analysis tools they will encounter in the workplace. Students analyze a variety of visualizations available in both software programs, completing assessment questions along the way to check their understanding and ability to interpret different forms of information, and practice making informed business decisions.

NEW! Analytics in Action End-of-Chapter Sections include feature boxes and activities that get students hands-on with data analysis applications within a real Excel environment. Students work with varied data sets, refine their Excel efficiency skills, practice creating visualizations, and learn how to think critically while evaluating and interpreting the data, thinking deeply about what types of decisions can be made within a real-world context that maps to chapter content.

The WileyPLUS Data Set Library provides instructors with the flexibility to choose how they want to build and assess students’ data analytics skills. A variety of free data sets are available for you to access across all WileyPLUS Accounting courses, saving you valuable time in sourcing out data sets to use with projects, assessments, and homework.

Prepare Students for CPA Exam Success

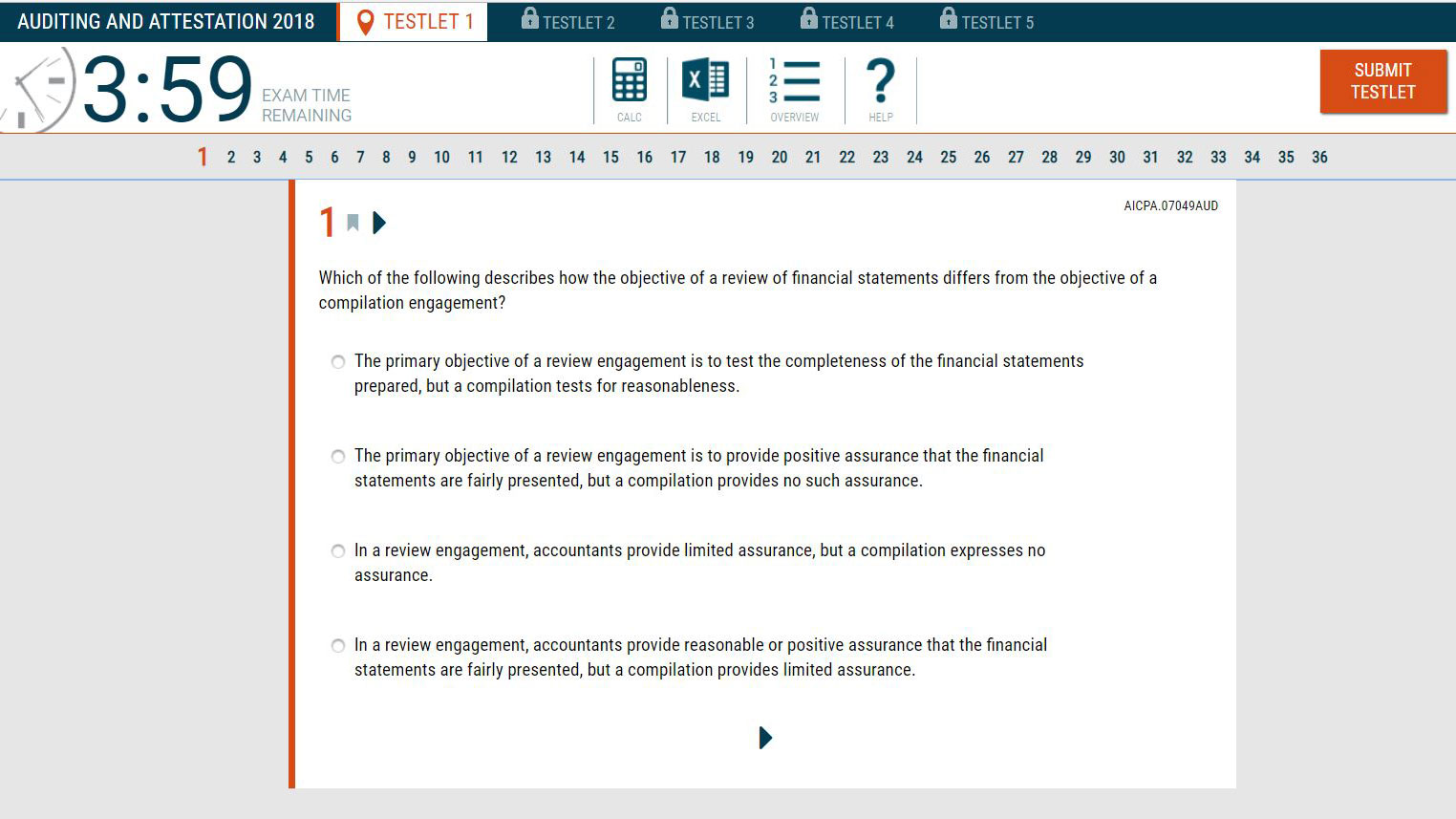

Seamlessly incorporated throughout each chapter in WileyPLUS, Integrated CPA Exam Review builds students’ confidence and prepares them for exam success through assignable task-based simulations, video content, and sample test questions that mimic the exam experience. Updated material will be added once the updated CPA Exam Blueprints from AICPA are released in January 2023.

A CPA Evolution Model Curriculum Mapping Document is available to help instructors confirm and/or update their intermediate accounting course to meet the AICPA’s recommended learning objectives.

Instructors Get Started Quickly with Pre-Built Courses

NEW! WileyPLUS Course Collection allows instructors to create their WileyPLUS courses confidently and easily by leveraging a library of gold-standard pre-built courses. Based on learning science, pre-built courses reflect insights from authors and subject matter experts to provide inspiration for engaging, effective course design and are fully customizable, giving you the flexibility to create your version of the perfect course.

What’s New to This Course

- New WileyPLUS Adaptive Assignments effectively close knowledge gaps through a personalized adaptive experience that provides just-in-time instruction, immediate feedback, and remediation to previous learning objectives. With 3 assignment types to choose from (Pre-Lecture, Practice, Review), instructors can leverage Adaptive Assignments in various ways to build their students’ confidence and mastery of course concepts.

- New Adaptive Chapter 0: Accounting Cycle Review identifies what knowledge gaps students have through an adaptive practice experience with just-in-time instruction and remediation. With personalized practice, students can recall and retain foundational material, helping them succeed and apply knowledge to the intermediate accounting course.

- New Interactive Tutorial Assignments keep students engaged and help break down chapter content and topics with a guided walkthrough that includes interactive Knowledge Check questions to ensure student understanding and retention. The Interactive Tutorial Assignments are available as practice, customizable and assignable by instructors for points, and are also included within the Adaptive Assignments pre-lecture assignment type.

- New Solution Walkthrough Videos with 24/7, just-in-time homework help, have been added and updated as new examples and problems, including Put It Into Practice problems, have been added.

- New Analytics in Action End-of-Chapter Sections include feature boxes and activities that get students hands-on with data analysis applications within a real Excel environment and practice working with varied data sets, refine their Excel efficiency skills, create visualizations, and learn how to think critically while evaluating and interpreting the data.

- Updated CPA Excel Lesson Videos have been added and highlight targeted CPA content in each chapter to further help prepare students for CPA Exam success.

- Updated CPA Excel Task-Based Simulations have been added to help students practice questions they are likely to come across on the CPA Exam and become familiar with the exam testing experience.

- New WileyPLUS Course Collection allows instructors leverage a library of gold-standard pre-built courses that are designed based on learning science. Pre-built courses reflect insights from authors and subject matter experts to provide inspiration for engaging, effective course design and are fully customizable.

Content Changes

- New contributors Laura Wiley, Louisiana State University and Kristen Fuhremann, University of Wisconsin-Madison, incorporate their course design, student engagement, and skill development expertise to further enhance the student learning experience within the content and WileyPLUS.

- New bulleted text and numbered approach with practice at the point of learning helps break down and highlight complex intermediate accounting concepts so students can easily understand the accounting applications through a step-by-step process.

- New chapter organization with the Financial Accounting and Accounting Standards and Conceptual Framework for Financial Reporting chapters combined into one single chapter.

- New Fundamentals of Revenue Recognition content has been added before Time Value of Money to give instructors flexibility in how they want to cover this topic, whether before or after the balance sheet material.

- New Put It Into Practice Brief Exercises have been added at the end of each learning objective to give students an opportunity to practice and apply concepts at the exact moment they were learned.

- New Worked Out Examples are available within each chapter and include facts, questions, and solutions to help students better understand the process of working through accounting problems and developing their own problem-solving skills.

- New Excel screenshots have replaced manual calculations to help students further develop their technical Excel skills while also providing a more realistic perspective into the accounting profession.

- New and updated data analytics coverage has been added including data analytics problems within the end-of-chapter content, chapter discussions, and feature boxes where appropriate to better expose students to data analytics and its application. New “Using Your Judgement” financial statement cases have been developed and incorporate concepts of analysis and critical thinking.

- New “Professional Development Skills” section has been added to replace the previous edition’s “Bridge to the Profession” section and will focus on codification, data analytics in action, Excl, and CPA multiple choice questions.

- New design and updated illustrations modernize the textbook’s aesthetic and provide a more student-friendly look and feel.

- New chapter openers engage students with the content at the start of each chapter and help provide context behind the “why” of what they’re learning.

- Updated end-of-chapter questions and assessment has been incorporated to ensure companies are relevant and questions are representative of the content changes made.

- Updated real-world examples throughout the text are more recognizable and relevant to today’s students.

- New “Accounting Matters” and “Analytics in Action” boxes have been incorporated throughout the text and integrate critical thinking, professional skills, and data analytics into each chapter.

- Updated IFRS treatment and coverage has been simplified for students and instructors, presenting the key similarities and differences to GAAP with an opportunity for application.

Donald E. Kieso, PhD, CPA, received his bachelor’s degree from Aurora University and his doctorate in accounting from the University of Illinois. He has served as chairman of the Department of Accountancy and is currently the KPMG Emeritus Professor of Accountancy at Northern Illinois University. He has public accounting experience with Price Waterhouse & Co. (San Francisco and Chicago) and Arthur Andersen & Co. (Chicago) and research experience with the research division of the American Institute of Certified Public Accountants (New York). He has done post doctorate work as a visiting scholar at the University of California at Berkeley and is a recipient of NIU’s Teaching Excellence Award and four Golden Apple Teaching Awards. Professor Kieso is the author of other accounting and business books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Illinois CPA Society. He has served as a member of the board of directors of the Illinois CPA Society, the AACSB’s Accounting Accreditation Committees, and the State of Illinois Comptroller’s Commission, and he has served as secretary-treasurer of the Federation of Schools of Accountancy and as secretary-treasurer of the American Accounting Association. Professor Kieso is currently serving on the board of trustees and executive committee of Aurora University, as a member of the board of directors of Kishwaukee Community Hospital, and as treasurer and director of Valley West Community Hospital. From 1989 to 1993, he served as a charter member of the national Accounting Education Change Commission. He is the recipient of the Outstanding Accounting Educator Award from the Illinois CPA Society, the FSA’s Joseph A. Silvoso Award of Merit, the NIU Foundation’s Humanitarian Award for Service to Higher Education, a Distinguished Service Award from the Illinois CPA Society, and in 2003, an honorary doctorate from Aurora University.

Jerry J. Weygandt, PhD, CPA, is Arthur Andersen Alumni Emeritus Professor of Accounting at the University of Wisconsin-Madison. He holds a PhD in accounting from the University of Illinois. Articles by Professor Weygandt have appeared in the Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Professor Weygandt is author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of the Accounting Review; he also has served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC). He has served on the FASB task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Professor Weygandt has received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

Terry D. Warfield, PhD, CPA, is the PwC Professor in Accounting at the University of Wisconsin-Madison. He received a B.S. and M.B.A. from Indiana University and a Ph.D. in accounting from the University of Iowa. Professor Warfield’s area of expertise is financial reporting, and prior to his academic career, he worked for five years in the banking industry. He served as the Academic Accounting Fellow in the Office of the Chief Accountant at the U.S. Securities and Exchange Commission in Washington, D.C., from 1995–1996. Professor Warfield’s primary research interests concern financial accounting standards and disclosure policies. He has published scholarly articles in The Accounting Review, Journal of Accounting and Economics, Research in Accounting Regulation, and Accounting Horizons, and he has served on the editorial boards of The Accounting Review, Accounting Horizons, and Issues in Accounting Education. He has served as president of the Financial Accounting and Reporting Section, the Financial Accounting Standards Committee of the American Accounting Association (Chair 1995–1996), and on the AAAFASB Research Conference Committee. He also served on the Financial Accounting Standards Advisory Council of the Financial Accounting Standards Board, and he currently serves as a trustee of the Financial Accounting Foundation. Professor Warfield has received teaching awards at both the University of Iowa and the University of Wisconsin, and he was named to the Teaching Academy at the University of Wisconsin in 1995. Professor Warfield has developed and published several case studies based on his research for use in accounting classes. These cases have been selected for the AICPA Professor-Practitioner Case Development Program and have been published in Issues in Accounting Education. He served on the Board of the Illinois CPA Society, then AACSB’s Accounting Accreditation Committees, the State of Illinois Comptroller’s Commission, as secretary-treasurer of the Federation of Schools of Accountancy, and as secretary-treasurer of the American Accounting Association.

Ch. 1: The Environment and Conceptual Framework of Financial Reporting

Ch. 2: Accounting Information System

Ch. 3: Income Statement & Revenue Recognition

Ch. 4: Balance Sheet and Statement of Cash Flows

Ch. 5: Time Value of Money

Ch. 6: Cash and Accounts Receivable

Ch. 7: Valuation of Inventories: A Cost-Basis Approach

Ch. 8: Inventories: Additional Valuation Issues

Ch. 9: Acquisition and Disposition of Property, Plant, and Equipment

Ch. 10: Depreciation, Impairments, and Depletion

Ch. 11: Intangible Asset

Ch. 12: Current Liabilities and Contingencies

Ch. 13: Long-Term Liabilities

Ch. 14: Stockholders’ Equity

Ch. 15: Dilutive Securities and Earnings per Share

Ch. 16: Investments

Ch. 17: Revenue Recognition

Ch. 18 Accounting for Income Taxes

Ch. 19: Pensions

Ch. 20: Leases

Ch. 21: Accounting Changes and Error Analysis

Ch. 22: Statement of Cash Flows

Ch. 23: Full disclosure