Fundamentals of Taxation for Individuals, 1st Edition

By Gregory Carnes and Suzanne Youngberg

Present the big picture with a practice-based approach to understanding tax laws so students can develop critical thinking and problem-solving skills that prepare them for the real world. Fundamentals of Taxation for Individuals, 1st Edition introduces a logical foundation with the income tax system so students can understand why a law exists and how to apply the law to practical tax problems. Professional skill-building exercises develop critical thinking and communication skills and the ability to identify and address ethical dilemmas, preparing students for future careers.

Schedule a Demo Request Instructor AccountWant to learn more about WileyPLUS? Click Here

Inspire efficient and effective learning of key concepts

Help students learn key concepts and an understanding of tax laws, the big picture, and the Why behind it. Chapter 2 introduces the principles of income taxation and presents tax rules as an application of the logical foundation. By presenting the income tax system this way students can better understand why the law was put in place – and start to appreciate the big picture.

Provide confidence-building opportunity with algorithmic auto-graded assignments, supported with author-created Solution Walkthrough Videos that give step-by-step instruction on how to complete problems like those in the text.

Activate knowledge application with real-world context.

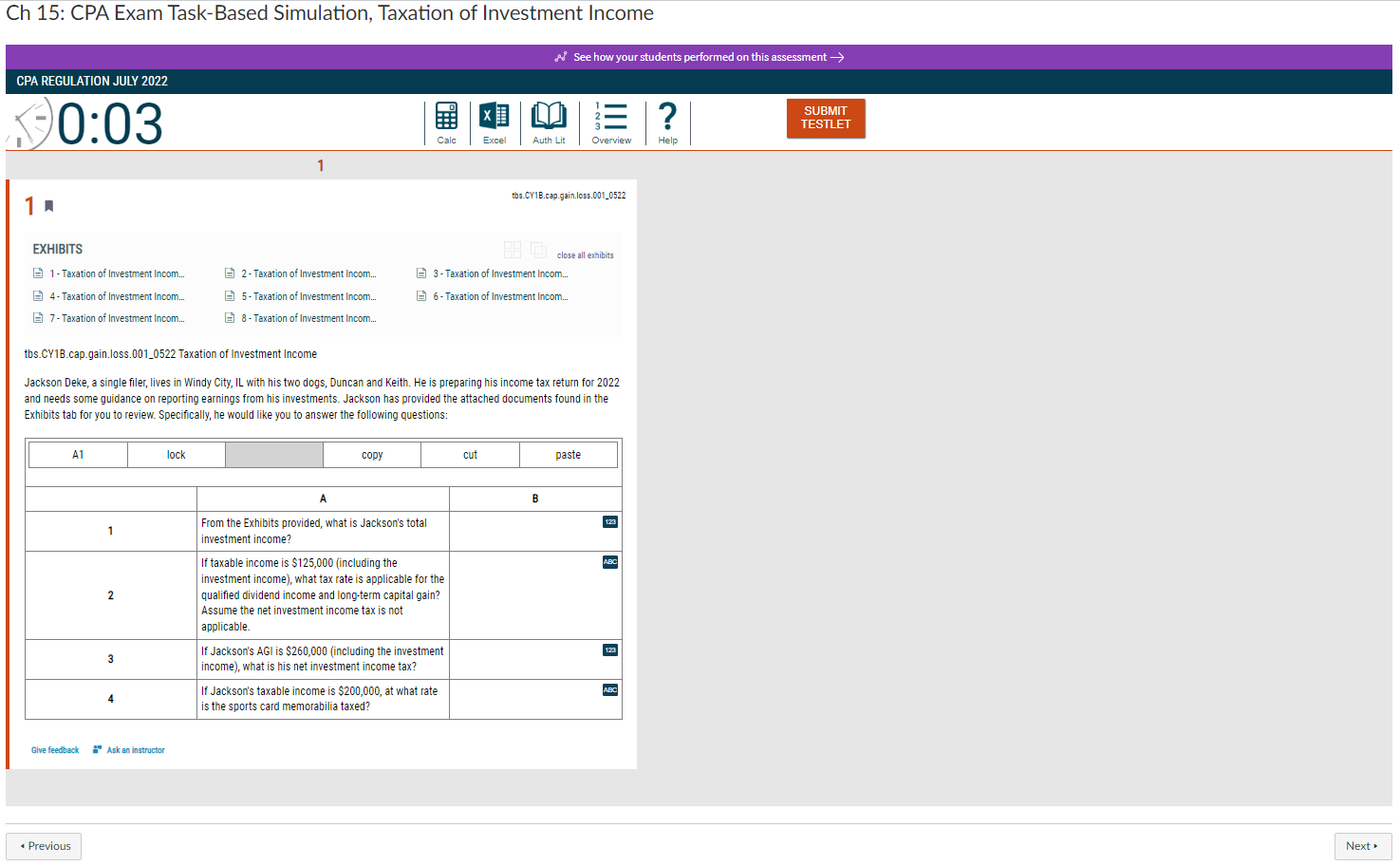

Prepare students for the CPA Exam with Task Based Simulations that include realistic source documents such as 1099s, W-2s, invoices, and legal agreements that students use to solve problem-solve.

Create a realistic environment to teach students how to apply their knowledge that will transfer to job-ready skills with Tax Planning, Tax Form and Tax Return Problems that include actual tax source documents. Comprehensive Tax Return Problems are included for each of the 5 parts.

Cultivate the analytics and problem-solving skills students need for career success.

Prepare students for the real world with Professional Development Skills Exercises that focus on tax compliance skills, analytical skills, research skills, communication skills, and the ability to identify and address ethical dilemmas.

Develop the Excel knowledge and skills students need using Gradable Excel, with problems that focus on tax planning. This provides the opportunity to practice using formulas and functions in a real Microsoft Excel worksheet, with automatic grading and immediate cell-level feedback, so students build essential skills while enhancing their understanding of taxation.

Key Resources & Features

- Integrated CPA Exam Preparation Materials set students up for success on the CPA exam through Multiple-Choice Practice Questions that mimic the exam experience, and Task-Based Simulations that bring together multiple learning objectives and provide students with an opportunity to apply their cumulative understanding with more complex activity.

- Auto-gradable tax forms simulating real-world scenarios provide opportunities for students to practice and develop important tax planning and analytical skills.

- Gradable Excel for selected end-of-topic and end-of-chapter homework questions are available to facilitate student practice of Excel skills.

- Content Review Videos provide a detailed review of each learning objective in each chapter.

- Solution Walk-Through Videos provide step-by-step guidance of the most exercises and problems in the end-of-chapter section of the textbook.

- Micro-lessons with scaffolded and integrated practice help to deepen student understanding, preparing them to learn how to apply laws to practical tax problems and be effective tax planners.

- Fundamental content is clearly delineated from advanced content to strengthen student understanding.

Dr. Gregory Carnes is Dean of the College of Business and Technology (COBT) and Raburn Eminent Scholar of Accounting at the University of North Alabama (UNA). Dr. Carnes is well known nationally as an academic leader, having served as President of the Accounting Program Leadership Group, President-Elect of the Federation of Schools of Accountancy, and Secretary of the American Taxation Association. He will begin a three-year term as a board member of the Southern Business Administrators Association in 2022. He has served as Chair of the Education Committee of the Alabama Society of CPAs and as President of the North Alabama ASCPA chapter. Dr. Carnes has published extensively in leading academic and professional journals, authored tax material for Wiley/CPA Excel, and is currently writing two tax textbooks for Wiley.

Suzanne Youngberg teaches at Northern Illinois University in both the graduate and undergraduate accounting program and has served as academic advisor for the NIU Master of Science in Taxation Program. Suzanne received her Bachelor of Science in Accountancy from NIU and her Master of Science in Taxation from DePaul University. Suzanne maintained her own tax practice for 30 years specializing in individual and small business compliance and strategic tax planning. She also worked in the tax department of a medium-sized public accounting firm. Her publication specialty is in individual taxation. She is co-author of Carnes, Fundamentals of Taxation for Individuals published by Wiley.

1 The Professional Practice of Taxation

2 Fundamentals of the Federal Income Tax System

3 Tax Authority, Research, Compliance Rules, and Professional Responsibilities

4 Dependents and Filing Status

5 Framework for Income Recognition

6 Income from Personal Activities

7 Income from Services

8 Framework for Deductions

9 Deductions for AGI and Itemized Deductions

10 Business Expenses

11 Limitations on Business Expenses

12 Taxation of Investment Income

13 Cost Recovery of Property

14 Taxation of Assets Used in a Trade or Business

15 Property Transactions: Nonrecognition of Gains and Losses

16 Personal Tax Credits

17 Alternative Minimum Tax and Other Taxes for Individuals

18 Business Entity Topics—CPA Exam Tax Core